Navigating the Online Space for Personal Finance Management

Discover how to manage your finances online confidently and efficiently.

Have you ever found yourself staring at your bank account wondering how on earth to make sense of it all? Or maybe you’re considering the idea of managing your personal finances online but feel a bit lost in the digital sea. I’ve been there, and today, I’d like to share some insights into how you can take charge of your finances online with a sense of calm and confidence.

Finding Your Financial Starting Point

Before diving into the world of online budgeting tools, it's essential to know your starting point. This step feels like locating yourself on a map before setting out on a journey. Begin by listing out your financial responsibilities — bills, loans, savings, and any sources of income. Creating a clear picture of where you stand financially lays the foundation for any future decision-making.

Choosing Tools that Suit Your Style

There are plenty of online tools available to help you manage your finances, from simple budgeting apps to comprehensive financial wellness platforms. It’s about finding one that matches your preferences and goals. For instance, some apps are ideal for tracking spending in real-time, while others focus on growing investments or planning for long-term goals. Spend some time exploring your options and choose a tool that feels comfortable and intuitive to use.

Staying Consistent

Consistency is key when managing finances online. Like any routine, forming a habit around regularly checking and updating your financial data can feel rewarding. Try to set a specific day and time each week to dedicate to this task. Perhaps make it a cozy moment with a cup of tea beside you, turning it into a ritual you look forward to rather than a chore.

Building Confidence in Your Investments

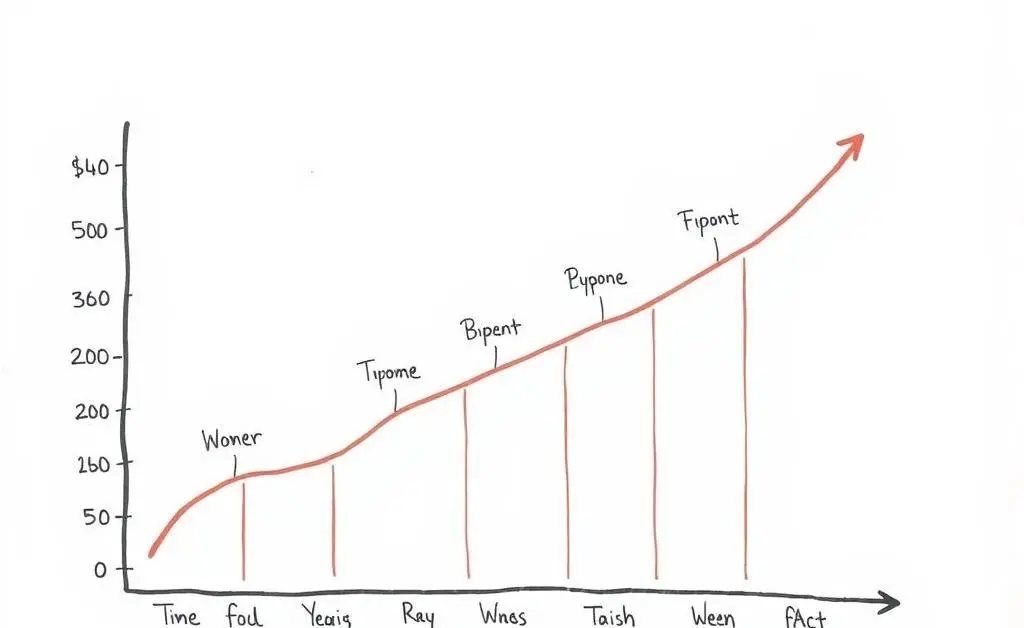

If you're looking into investing, you may have heard a plethora of advice — some helpful and some merely noise. Educating yourself using credible sources can empower you to make confident investment choices. Resources like Investor.gov are invaluable for beginners and can demystify complex concepts. Remember, investing isn’t just about making money; it's about achieving personal financial goals.

The Emotional Journey of Financial Management

Managing money can often stir up a slew of emotions, from anxiety to empowerment. Each step forward is a little victory, so allow yourself to feel proud of the progress you make. Embracing the ups and downs of financial management as a learning experience can transform your approach, making the journey just as fulfilling as the destination.

In closing, remember that stepping into the online space for financial management is a personal journey, one that requires patience and kindness toward oneself. By taking just one step at a time, you can gradually shape a financial future that aligns with your values and dreams.