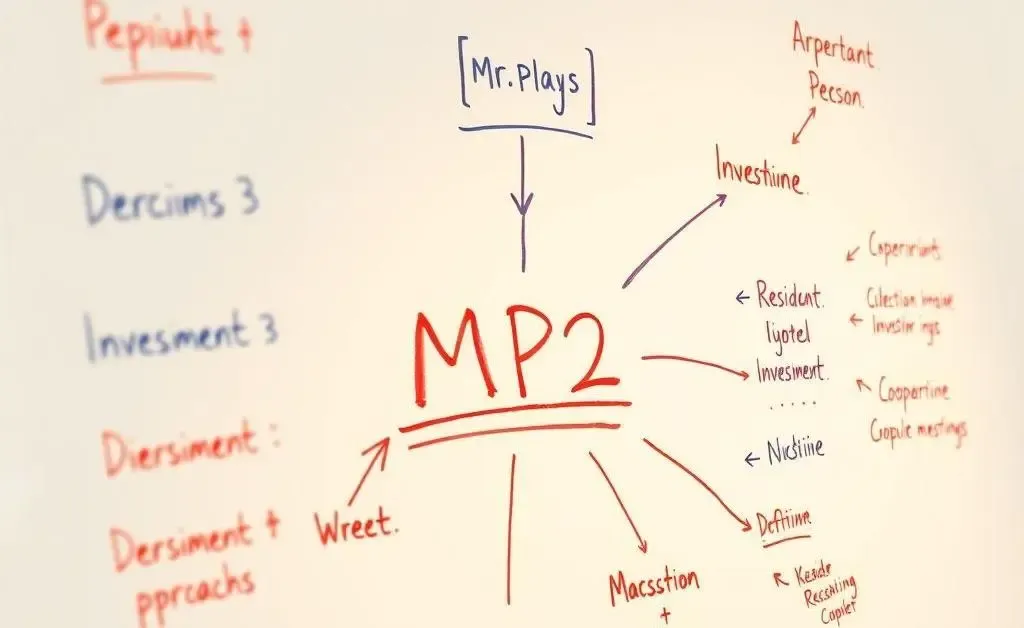

Navigating the Waters of MP2 Savings: Tips for a Smooth Journey

Learn practical MP2 withdrawal tips & insights to make the most of your savings.

Hey there! If you're exploring ways to safeguard your hard-earned money and make it work for you, you've probably stumbled upon the Modified Pag-IBIG 2 or MP2 program. I've been there too, and I know it can be a bit of a puzzle, especially when it comes to figuring out the withdrawal process and maximizing your gains.

Why MP2 Could Be Your Best Financial Friend

The MP2 savings program is like a hidden gem for many Filipinos. It offers a higher dividend return compared to your standard savings accounts or time deposits. The best part? Earnings from it are tax-free! That certainly beats keeping your money under the mattress.

Understanding the MP2 Withdrawal Process

When you're ready to cash in on your MP2 savings, knowing the step-by-step process can save you a lot of time and headaches. First, make sure your account's five-year term is up unless you've got pressing reasons to withdraw earlier. Early withdrawals could mean forfeiting your dividends, so timing is everything!

You'll need to head to the nearest Pag-IBIG branch or use their online services, though the face-to-face route might give you a more personalized experience. Just don't forget your MP2 Certificate and two valid IDs!

Pros and Cons of MP2 Investment

| Pros | Cons |

|---|---|

| High dividend rates | 5-year lock-in period |

| Tax-free earnings | Penalty for early withdrawal |

| Flexible contribution amounts | Not insured by PDIC |

Like any investment, MP2 has its pros and cons. While it offers high dividend rates and tax-free growth, you must commit to its five-year lock-in unless you are prepared to face penalties. Plus, it's not insured by the PDIC, which might be a deal-breaker for risk-averse investors.

Making MP2 Work for You

If you're serious about using MP2 as part of your financial strategy, think about integrating it with other investment streams. Diversification is key to reducing risk and enhancing potential rewards.

I once discussed MP2 with a friend over coffee, and she gave me an 'aha' moment—you can actually use the dividends from MP2 to fund short-term financial goals while letting the principal grow for the full term. Brilliant, right?

Final Thoughts

So, is MP2 worth it? I'd say a resounding yes, especially if you're looking for a low-risk investment with a decent return. Just remember to do your homework, understand the terms, and keep your eyes on your financial goals.

What about you? Have you tried investing in MP2, or are you still on the fence? I'd love to hear your thoughts!