Navigating the World of Life Insurance: A Practical Guide

Explore key insights to choose the right life insurance plan without the stress.

Have you ever found yourself staring at a stack of life insurance brochures and feeling utterly overwhelmed? If so, you’re definitely not alone. With terms like 'premiums', 'beneficiaries', and 'coverage', diving into life insurance can feel more like navigating a maze than planning for your future.

Let's start by unraveling some of that confusion and look at how choosing the right life insurance doesn't have to be daunting.

Understanding Your Needs

Think of life insurance as a financial safety net. It’s there to catch your loved ones if the unexpected happens. The first step? Understanding what you really need. Are you looking to cover debts, ensure your child's education, or simply give yourself peace of mind?

- Assess your current financial obligations.

- Consider future goals like college tuition for kids.

- Think about long-term care for dependents.

Figuring these out will guide the type of policy that aligns with your goals, whether it’s term or whole life insurance.

A Personalized Approach to Policies

Imagine this: my friend Jake, who just turned 65, once recounted how he felt swamped when exploring potential life insurance policies. He did what many would do—dove straight into comparison websites, only to emerge more confused than ever. That's when we chatted, and through a simple conversation, he realized what he actually needed: something to support his grandchildren's college dreams. Context changed everything for him.

Comparing Your Options

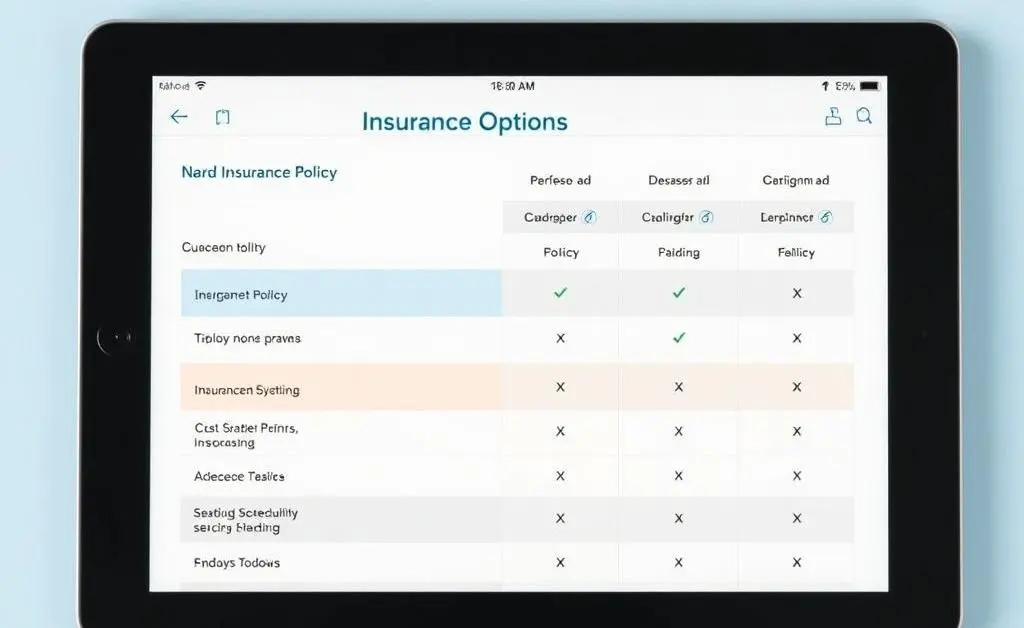

Comparison tools are godsends if used correctly. With thousands of options out there, a simple click can mean facing a flood of numbers. Here’s how to simplify the process:

1. Identify reputable resources, perhaps even a trusted agent who can translate the financial jargon.

2. Focus on essential terms like monthly premiums and coverage length.

3. Ensure any policy matches your financial blueprint.

With thoughtful planning, these tools can be empowering rather than overwhelming.

Ready to Dive In?

The world of life insurance might seem vast, but with clarity on personal needs and a smart approach to comparison, it becomes a cornerstone of a secure financial future. What’s been your journey in choosing life insurance so far? Are there hurdles you’ve faced or strategies that worked for you?