Navigating the World of LTV Ratios: What You Need to Know

Unlock the secrets of LTV ratios in mortgages with practical tips and insights. Empower your financial decisions.

Have you ever wondered how much house you can really afford? If you’re diving into the world of mortgages, you’ve probably heard the term Loan-to-Value (LTV) ratio tossed around. Understanding LTV is crucial because it can impact not just your ability to get a mortgage, but also the rates you'll pay. Let’s unravel this often mystifying concept together.

What is LTV Ratio?

The LTV ratio is a simple but powerful figure in the mortgage industry. It tells lenders the relationship between the loan amount and the value of the property being purchased. Simply put, it’s the percentage of the property’s value that is being financed. For example, if you’re buying a $200,000 home with a $160,000 loan, your LTV ratio is 80%.

Why Does the LTV Ratio Matter?

Lenders use the LTV ratio to assess risk. A higher LTV means more risk for the lender, which can lead to higher interest rates or a need for mortgage insurance. It’s a bit like lending a friend a sweater; the less they need it, the more likely they are to give it back in perfect condition.

How to Improve Your LTV Ratio

Improving your LTV ratio isn’t about magic; it’s about strategy. Here are a few practical tips:

- Increase Your Down Payment: The most direct way to reduce your LTV is by putting down a larger down payment.

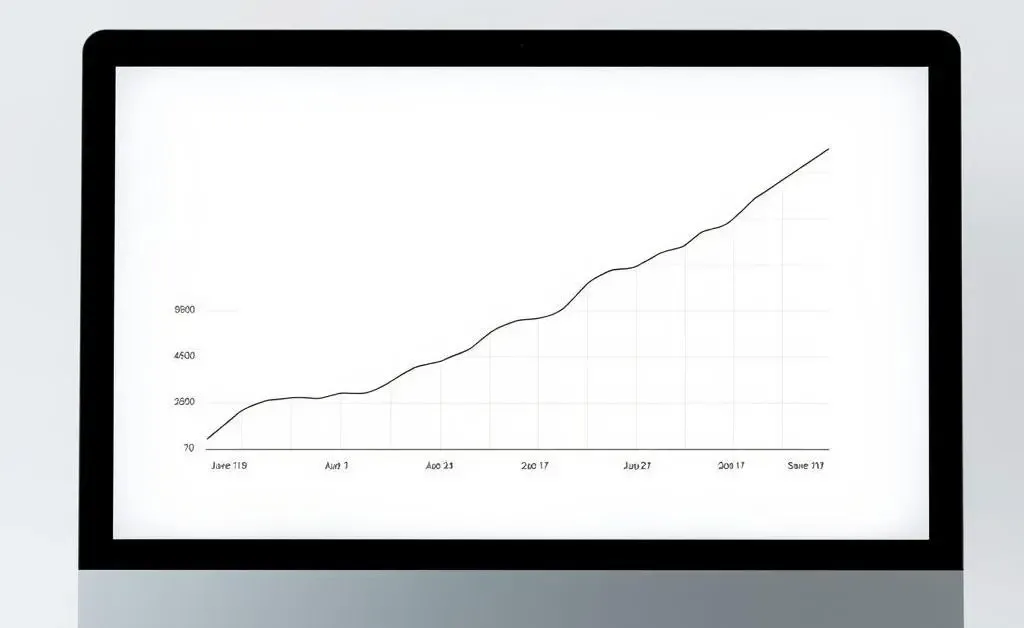

- Seek Property Value Increases: A property’s value can increase over time with market changes or renovations.

- Pay Down Your Loan: Regularly paying above the minimum mortgage payments can help reduce the principal faster than planned.

A Personal Story

I remember when I bought my first home. It was a cute little cottage, but saving for the down payment felt like climbing Everest. I chose to budget strictly and even took on a side gig to boost my savings. When I finally closed on the house, my lower LTV ratio meant I snagged a better interest rate. Was sacrificing some weekends worth it? Absolutely!

The Sweet Spot for LTV

Most lenders prefer an LTV ratio of 80% or lower. This threshold often allows you to avoid additional costs like private mortgage insurance (PMI). Making sure you’re in the “sweet spot” can save you a lot of money over the life of your loan.

Conclusion

Understanding the intricacies of the LTV ratio empowers you to make informed financial decisions. It’s not just about qualifying for a loan, but about securing the best terms possible. Feeling inspired to apply these tips to your own home-buying journey? What strategies have you found helpful to improve your financial knowledge?