Navigating the World of Personal Finance with Confidence

Discover actionable steps for financial peace of mind.

Understanding the Basics of Personal Finance

Have you ever felt that wave of panic looking at your bank account after a month of expenses? You're not alone. Many people find personal finance to be a daunting topic. But what if I told you it doesn't have to be that way?

Getting a handle on your finances involves understanding some basic principles. Let’s break these down into manageable steps:

- Crafting a monthly budget

- Setting up an emergency fund

- Understanding investment options

- Tracking your spending habits

Budgeting: Your Financial Blueprint

Think of budgeting as painting a picture where numbers help illustrate your financial landscape. Start by listing your income sources against monthly expenses. A simple coffee here, a subscription there—these can add up quickly! Finding that balance quietly brings you peace of mind.

Establishing an Emergency Fund

Emergencies, by nature, are unpredictable. Having funds set aside, equivalent to three to six months of living expenses, constitutes an anchor in times of unexpected financial storms. It's like insurance, but for your peace of mind.

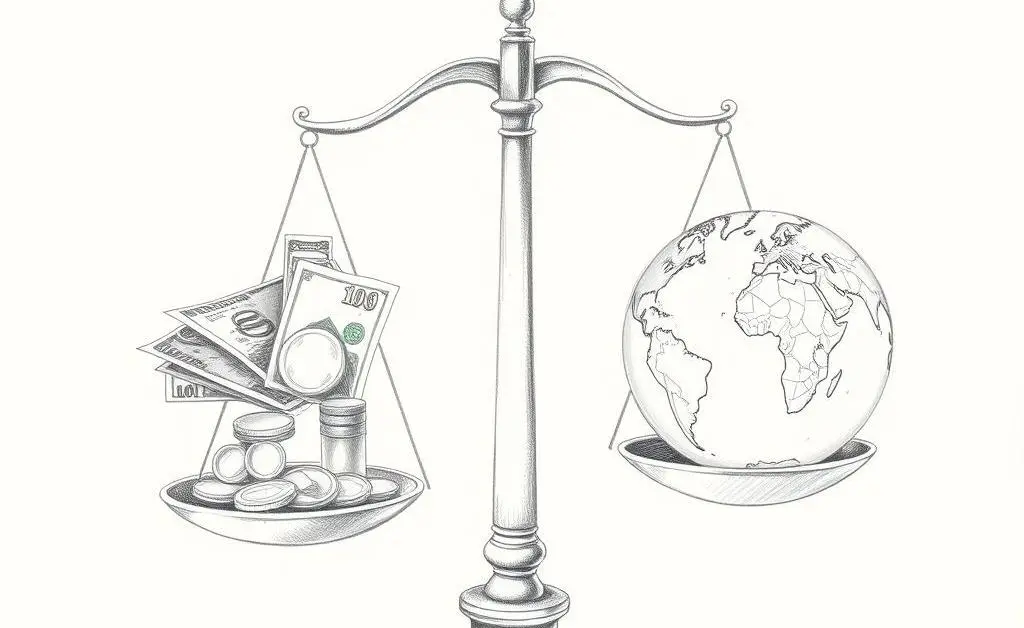

Investing: Grow Your Wealth

Investing might sound like entering a foreign land, but with a bit of research, it can become an exciting journey! Think of it as planting a tree—it's crucial to start with the right seeds (investments) and nurturing them (monitoring and adjusting over time).

Consider starting with low-risk options like bonds or index funds before diving into more volatile investments. Modern platforms make it easier than ever to dip your toes into the investing pool.

Embrace Financial Wisdom

Imagine feeling like your finances are solid and under control. Picture a scenario where you're no longer scared of unexpected bills because you've planned for them. Pretty comforting, isn't it?

The key is patience and staying informed—like knowing the basics of plans that can change your life. So, how do you take the first step toward financial wisdom today? What's the first financial goal you want to achieve on your journey?