Navigating the World of Personal Loans: Tips for a Smooth Journey

Discover practical insights on securing personal loans with confidence and clarity.

Have you ever found yourself wading through a sea of loan options, unsure which way to turn? You're not alone. The world of personal loans can seem overwhelming, but with a little guidance, you can sail smoothly through the process. Let's dive into some practical insights that can help you make informed decisions when you're in the market for borrowing.

Understanding Your Needs

Before you even start shopping around for loans, take a moment to evaluate what you truly need. Are you consolidating debt, funding a significant purchase, or handling unexpected expenses? Identifying your purpose will guide your search for the most appropriate loan terms.

Here's a quick story: my friend Anna found herself needing a loan for home renovation. Initially, she felt lost amidst the different loan options. But after sitting down and identifying her specific needs, she felt much more confident about her choices. She knew exactly what to look for – a loan with a low-interest rate and flexible repayment terms.

Shopping for the Best Offer

Once you've pinpointed your needs, it's time to scout for the best deals. Here are some tips to keep in mind:

- Research Multiple Lenders: Don't settle on the first offer. Compare interest rates, fees, and terms from different lenders.

- Read the Fine Print: It might be the least exciting part, but understanding the details can save you from unwanted surprises down the line.

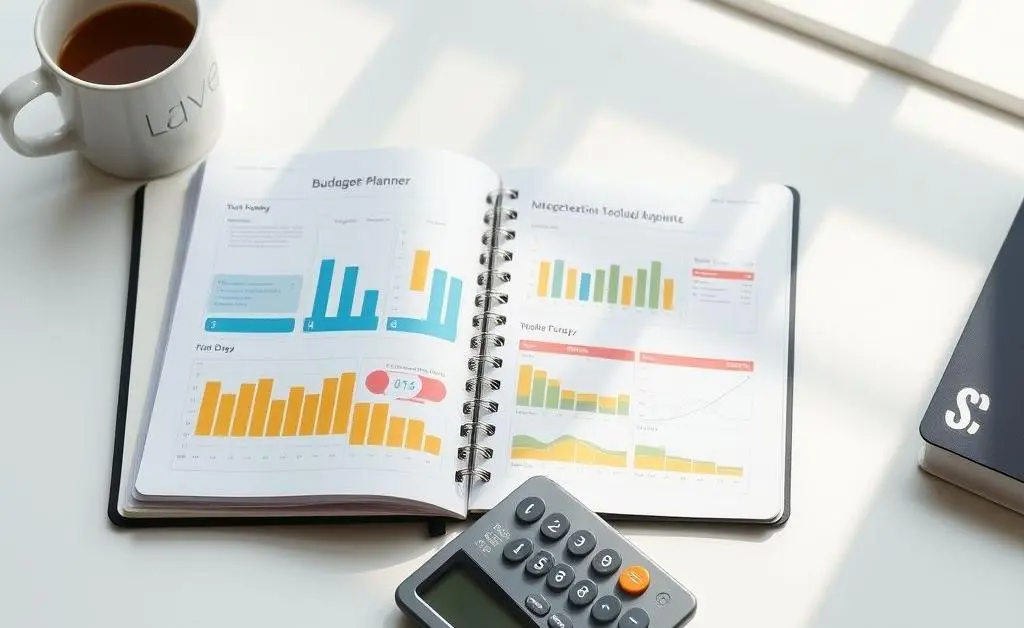

- Use Online Calculators: These handy tools help simulate your potential loan costs, allowing you to see if a loan fits your budget.

Credit Score Considerations

Your credit score will play a significant role in your loan eligibility and interest rates. So, it's wise to check your credit health before diving in. If your score isn't where you'd like it to be, consider taking steps to improve it, like paying bills on time or reducing outstanding debts.

Staying Organized

Once you've secured your loan, staying organized with repayments is crucial. Creating a budget will help. My suggestion? Start with a simple approach:

- Record Payment Dates: Set reminders to avoid late fees.

- Auto-Debit from Savings: Automate payments to minimize missed deadlines.

- Regularly Review Your Financial Plan: Make adjustments as needed to accommodate life changes.

By maintaining organization and staying proactive, Anna not only paid off her loan early but also improved her credit score. How has managing personal loans affected your financial journey? What tips do you swear by? Feel free to share your insights in the comments below!