Navigating Unexpected Financial Decisions: A Guide to Calm and Clarity

Find peace and practicality in addressing surprise financial choices together.

It happens to the best of us—you find yourself in the midst of unexpected financial decisions that have the potential to shake the very core of your daily life. Imagine sipping tea while marveling at your partner's latest surprise—perhaps a new rental agreement or a financial endeavor that wasn't exactly planned together. Navigating these waters requires a blend of calm understanding and practical steps to steer back on course.

Understanding the Decision and Its Impact

First things first, let's gently explore the decision itself. Knowing why the choice was made can open up avenues for understanding. Was it an opportunity that seemed too good to pass up, or a step towards achieving a personal goal? Learning to ask open-ended questions paves the way toward empathetic discussions. Finding common ground here is crucial—it sets the scene for collaborative problem-solving.

Reflect, Breathe, and Plan Together

Before diving into solutions, take a moment to breathe and reflect. A quiet space, perhaps with calming light and gentle sounds, can be the perfect setting for this. It's key to process emotions first—both for you and your partner. This gives clarity a chance to settle in before heated discussions take over.

Once calm, it's time to plan together. Consolidate your financial landscape: debts, assets, and future goals. Transparency here fosters an atmosphere of trust. It's okay if this feels like uncharted territory; sometimes the most productive conversations come from vulnerable places.

Budgeting as a Team

Creating or revisiting a budget can serve as the glue that holds your financial plans. Budgeting isn't just about numbers—it's about aligning your dreams and realities as a team. Discuss your individual and collective aspirations and experiment with different budgeting methods to find one that truly works for you.

For example, perhaps the 50/30/20 rule—a simple yet effective approach—can help balance needs, wants, and savings. Or maybe a more detailed envelope system suits your needs. Remember, flexibility is your friend here. Life is dynamic, and your budgeting should be too.

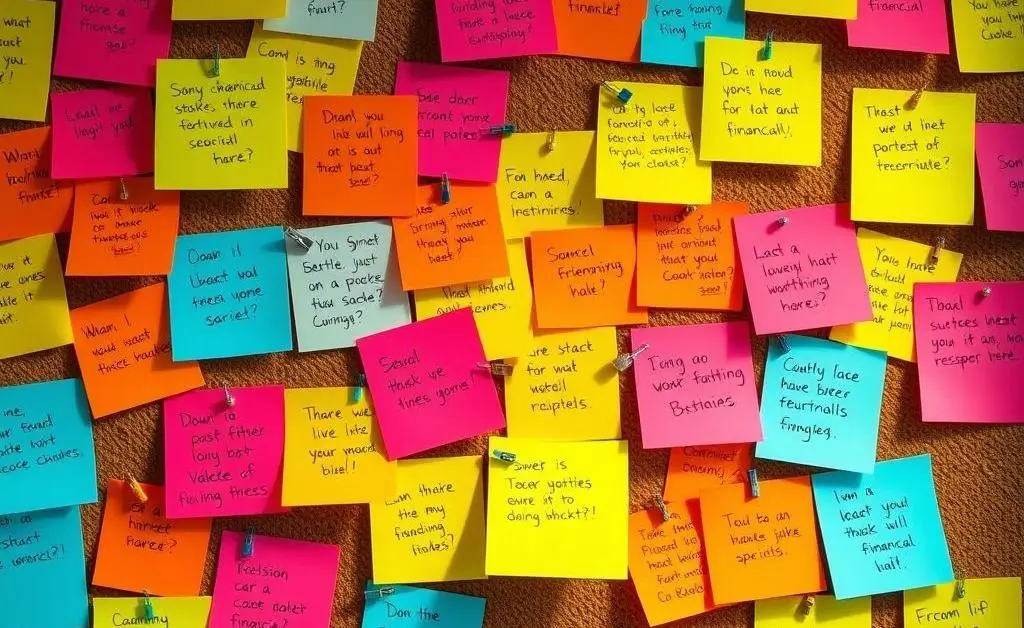

Building a Vision Board of Financial Goals

Consider crafting a vision board that represents both of your financial dreams. Pinpoint short-term goals like a vacation or long-term ones like retirement plans. This tangible visualization can serve as a daily reminder of the journey you're embarking on together.

Embrace the Journey

In the end, unexpected financial choices can feel like a test, but they can also strengthen partnerships when approached with grace, patience, and open hearts. It’s all about the journey you take together—armed with insights, compassion, and flexibility. So next time you find surprise knocking at your financial doorstep, you'll be ready to invite it in for a thoughtful conversation.

Do you have any budgeting tips that have transformed your own financial discussions? I'd love to hear about them in the comments below!