Navigating Your 401(k) to IRA Rollover: A Simple Guide to Enhance Your Retirement Savings

Learn how to seamlessly transition your 401(k) to an IRA and optimize your retirement strategy.

Ever felt like navigating your retirement savings is like wandering through a maze? You're definitely not alone. The decision to roll over your 401(k) to an IRA can be perplexing, but it might just be the key to leveraging better investment opportunities.

Let's dive into why considering a rollover could brighten your retirement horizon and how you can do it seamlessly.

Why Consider a 401(k) to IRA Rollover?

Imagine you're at a crossroads—on one side, your trusty 401(k), a secure yet sometimes restrictive path. On the other, a shiny IRA await, promising flexibility and more control over your investments. Intrigued? Here's why a rollover might catch your fancy:

- More Investment Choices: IRAs often provide a wider array of investment options compared to your employer-sponsored plans.

- Fee Management: IRAs potentially offer lower fees, helping you keep more of your money working for you.

- Better Control: With an IRA, you have the freedom to switch custodians more easily if you're not satisfied.

When rolling over my own 401(k) after switching jobs, I realized I wanted more flexibility than my employer's plan offered. After a bit of research, I made the leap to an IRA and unlocked a wider world of investment choices—hello, index funds and ETFs.

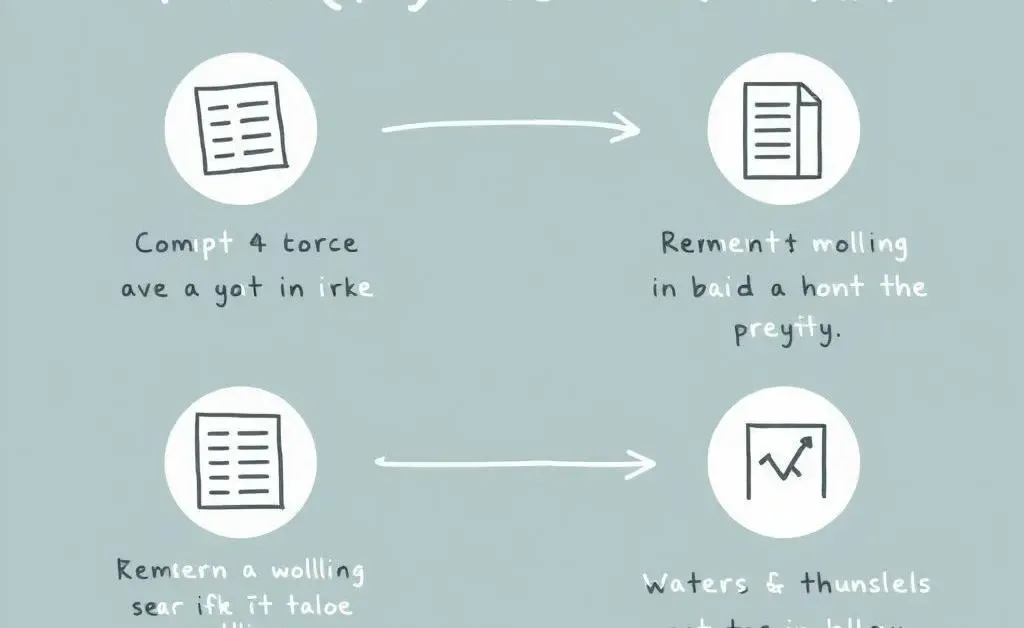

The Roll-Over Process Made Simple

Rolling over doesn't have to be a complex scavenger hunt. Here's a simplified roadmap:

- Choose Your IRA: Research and select a financial institution that meets your investment needs.

- Contact Your Current Plan Administrator: Let them know your intent to roll over and they will guide you on the necessary steps.

- Initiate the Transfer: A direct rollover is often recommended to avoid tax implications.

- Invest Your Funds: Once the funds are transferred, select your preferred investments in the IRA.

It's a straightforward journey once you've outlined the steps, bringing you one step closer to a personalized retirement plan.

Is a Rollover the Right Move for You?

The notion of unlocking greater investment potential sounds appealing, doesn't it? Yet, it's essential to weigh your current plan benefits against the merits of an IRA. Ask yourself about your financial goals, desired investment choices, and fee structures.

What’s your next move on the path to a fulfilling retirement? Have you considered what best aligns with your anticipated future? Let’s continue the conversation—I'd love to hear your thoughts!