Navigating Your Financial Future: Fixed-Rate Annuities and Beyond

Discover how fixed-rate annuities fit into your financial plan.

Hey there! It’s time we have a friendly chat about something that can feel like a labyrinth - personal finance, particularly fixed-rate annuities.

We all want financial security, right? Yet, navigating the sea of options out there can be overwhelming. Don’t worry, I’ve got you covered. Let’s dive into understanding fixed-rate annuities and how they might fit into your overall financial picture.

What Is a Fixed-Rate Annuity?

Simply put, a fixed-rate annuity is an insurance product that provides you with a guaranteed interest rate on money you deposit. Think of it as a safe and steady performer on your team of investments. It’s all about stability and predictability.

Why Consider It?

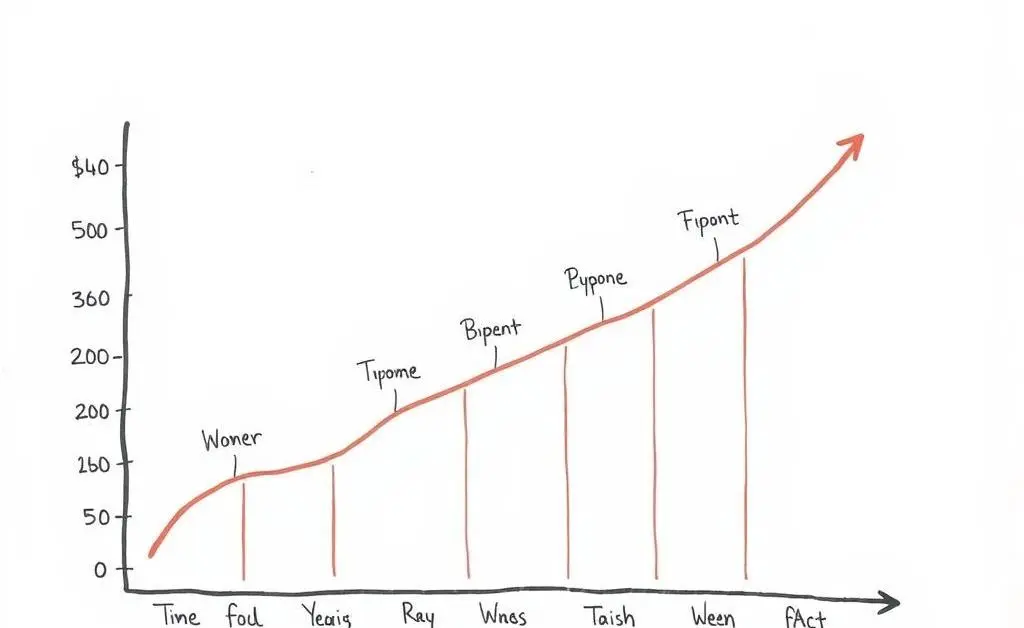

Here’s the kicker—unlike the stock market rollercoaster, fixed-rate annuities aren’t subject to market fluctuation. You’ll get a fair idea of what your return will be over time. Sounds comforting, doesn’t it?

- Safety: Your investment is not at the whim of market volatility.

- Simplicity: No need to be an investment whiz. Once you’re in, it’s hands-off.

- Income: Offers a source of income, especially crucial for retirement planning.

Balancing Risks and Rewards

We need to be honest about the flipside. These don’t offer the high returns you might see from riskier investments. Here’s where crafting a balanced investment portfolio comes into play. It might include a mix of stocks, bonds, and yes, even fixed-rate annuities for that peace of mind.

Is It Right for You?

If you value security and low-risk investment, a fixed-rate annuity could be a good choice. They’re effective for those nearing retirement who want guaranteed income.

The key is to make a decision that aligns with your financial goals. Consider consulting with a financial advisor to lay out your options. Remember, it’s all about feeling secure and confident in your choices.

Your Financial Journey Awaits

We might not all be financial gurus, but gaining a clear understanding of options like fixed-rate annuities can empower us to make confident decisions for our future. Think of it as setting your financial GPS.

As you ponder your next steps, what financial goals are you dreaming about? Is there a milestone you’re working towards? Take a moment to reflect, and let’s continue this journey together.

Happy planning!