Navigating Your Financial Journey: A Thoughtful Guide for Beginners

Discover practical financial advice to help beginners navigate money with confidence and ease.

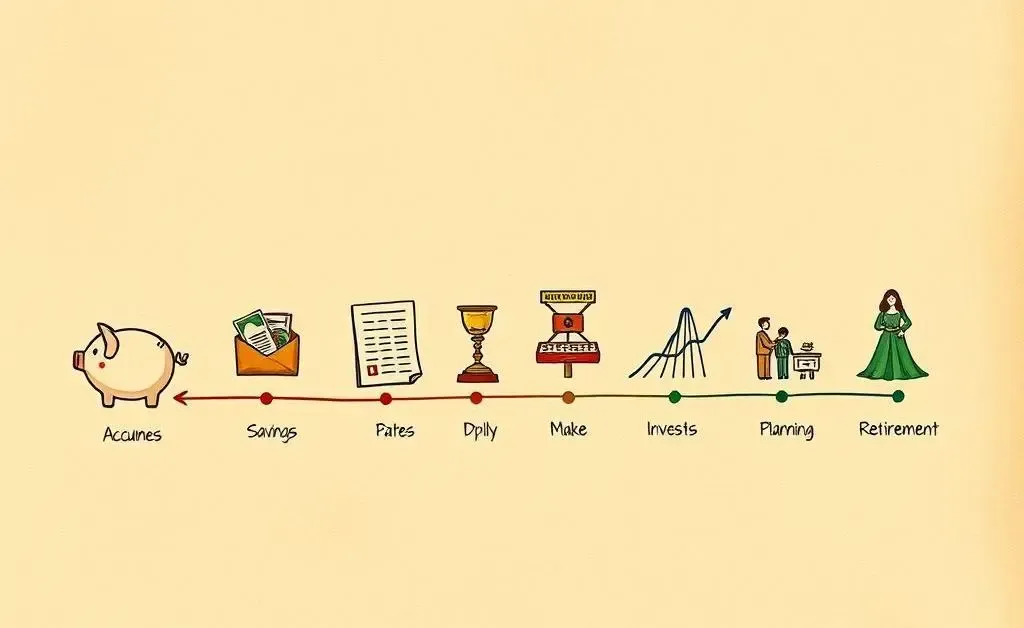

If you've ever felt a bit overwhelmed by the prospect of managing your finances, trust me, you're not alone. Many of us, as we embark on our financial journeys, encounter a myriad of questions. How do I save effectively? Where should I start investing? And, most importantly, how do I create a financial roadmap that works for me?

Understanding the Basics of Budgeting

Let's kick things off with budgeting, the foundation of any sound financial plan. Think of it as your roadmap, highlighting where your money should go rather than just wondering where it went. A simple way to start is by categorizing your expenses: essentials like rent and groceries, savings, and discretionary spending.

Tools such as budgeting apps can be incredibly helpful here, offering insights and automatic tracking of your spending, giving you a clearer picture and sense of control. This guide can offer some insight into effective budgeting techniques.

Achieving Your Savings Goals

Savings are like the guardrails of a budget, providing cushioning for unexpected expenses and helping you work towards future goals. Start by identifying what those goals are—perhaps it's an emergency fund or a dream vacation. Allocate a part of your income to these goals each month.

Have you heard of the 50/30/20 rule? It suggests that you dedicate 50% of your income to needs, 30% to wants, and 20% to savings. It offers a flexible yet structured approach to managing your finances.

Stepping Into the World of Investment

Investing often seems daunting, but it’s a crucial step in building wealth over time. Begin by understanding that investments, like savings, work best with a plan. Discover what interests you and aligns with your values—be it stocks, bonds, or mutual funds.

Educate yourself through resources like Investor.gov which offers a plethora of information for beginner investors.

Creating Your Unique Financial Path

Your financial journey is uniquely yours, shaped by your goals, values, and circumstances. As you navigate this path, remember to revisit and adapt your strategies—life is dynamic, and so too should be your plan.

In the end, financial planning is less about having all the answers and more about asking the right questions. What do you need to feel secure? How can you align your finances with your life goals? Consider these as you chart your course. After all, every journey starts with a single step, and this journey is one of growth, learning, and empowerment.