Navigating Your Financial Journey with Confidence

Explore budgeting and investment tips with an empathetic touch.

Have you ever found yourself sitting in a cozy spot, cup of tea in hand, casually pondering the grand tapestry of personal finance? If so, you’re not alone. In today's blog, we're embarking on a heart-to-heart chat about something that tends to look more intimidating than it really is—making financial decisions with confidence.

Whether you're at the beginning of your financial journey or a seasoned pro trying to map out your next steps, there’s a common thread: the desire for clarity and control.

Building a Financial Foundation

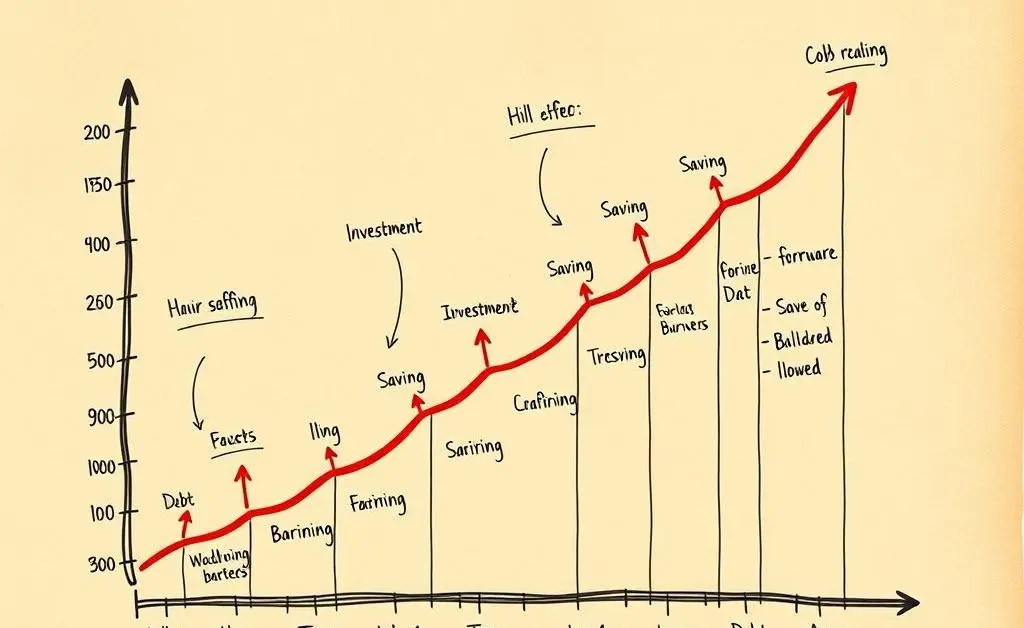

You might think of your finances as a complex puzzle, each piece representing a different aspect of your life—savings, expenses, investments, and perhaps a mortgage, if that's part of your current scenario. To get a sense of where to start, let’s break it down.

- Create a budget: Begin by understanding where your money flows each month. This process can be as simple as jotting down regular expenses versus income. There are some great tools out there, like Mint, that can help automate this task.

- Set clear goals: What do you want to achieve? Perhaps you're saving for a home, planning a dream vacation, or just want to build an emergency fund.

- Track your progress: Regular reviews can make this journey feel less like guesswork and more like a guided tour.

As you lay out these initial steps, know that it’s perfectly normal to adjust your financial plans over time. You're evolving, and so should your strategy.

Embracing Investment Choices

Dipping a toe—or even a whole foot—into the investment pool can seem daunting, but it doesn't need to be. It's about making informed choices that align with your values and goals.

First, familiarize yourself with different types of investments. Stocks, bonds, mutual funds—each comes with its own flavor of risk and reward. If you're new to this, resources like Investopedia can offer digestible insights.

Remember, investment is not about timing the market; it’s about time in the market. Start small, keep learning, and soon, you'll find your rhythm.

Reflection and Growth

As we wrap up our chat, there’s one last thing I want to remind you: personal finance is a journey that grows with you. Celebrate small wins along the way, and don’t hesitate to adjust your path as your life changes.

Have any thoughts or personal stories you’d like to share about your financial journey? I’d love to hear them in the comments below. After all, we’re in this together.