Navigating Your First Investment: Simple Steps for Beginners

Kickstart your investment journey with these essential beginner tips.

Getting started with investing can feel like opening a book in a foreign language. You've got complicated terms flying around, like 'asset allocation' or 'diversification', and it all sounds overwhelming. But it doesn't have to be! Let me break it down for you in a friendly, conversational way that’s easy to digest.

Why Start Investing?

If you're asking yourself why you should consider investing, you're already on the right track. The primary keyword here is wealth building. Investing allows your money to grow over time, often at a rate much higher than if it were sitting in a savings account.

Consider this: a savings account might offer you an interest rate of around 0.5% annually. Contrast that with the average historical return of the stock market, which has been around 7%. Makes a big difference, right?

Understanding Your Financial Goals

Before you dive into the world of investments, it's crucial to understand what you're hoping to achieve. Are you saving for retirement, or maybe a down payment on a house? Knowing your goals will help guide your investment strategy.

Short-term vs. Long-term Investments

Depending on your goals, you might choose different investment types. Short-term investments (held for less than three years) might include bonds or a certificate of deposit. Long-term investments (think over five years) usually involve stocks or mutual funds, things you can leave untouched and let compound over time.

Understanding Risks

Here's where many people feel a bit anxious: the risk. Different investment types come with varying levels of risk. Stocks, for example, can be very volatile, but they also offer high returns. Bonds are steadier, providing predictable yet lower returns.

My tip? Don't put all your eggs in one basket. Diversifying your portfolio can help manage risk. By investing in a mix of asset types, you’re more likely to weather market ups and downs.

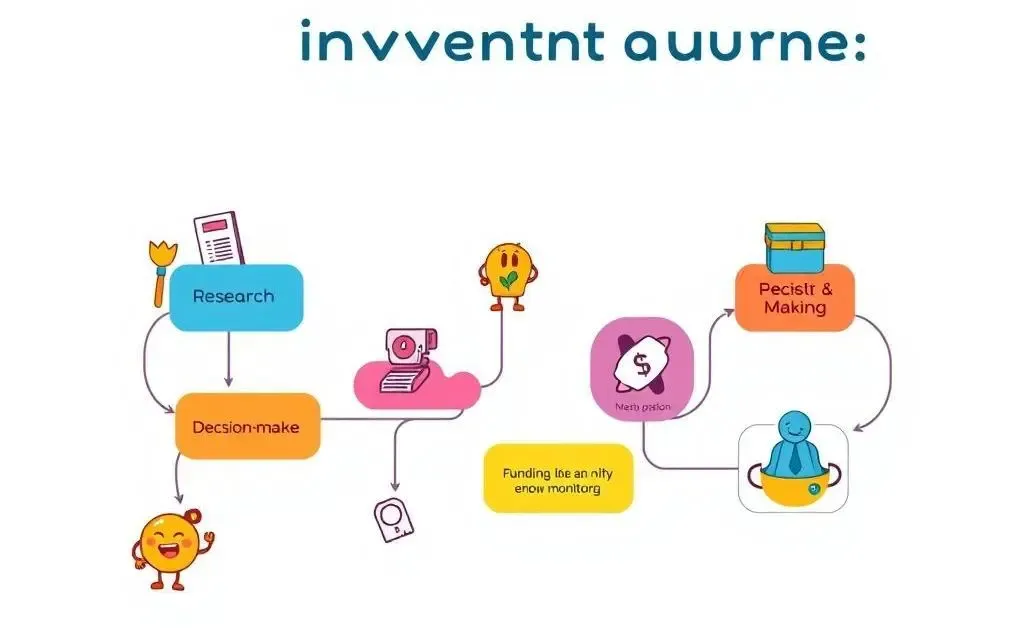

Getting Started: Baby Steps

Awesome, now that we’ve gotten the basics down, let’s talk about how you can get started.

- Set Up an Emergency Fund: Before jumping into investments, ensure you have three to six months' worth of expenses saved.

- Open a Brokerage Account: This is your gateway to buying stocks, bonds, and other assets.

- Start with Index Funds: They are a great way to get exposure to the stock market with relatively low risk.

Staying the Course

Finally, remember that investments are a long game. Avoid the temptation to check your portfolio every hour or react emotionally to market fluctuations. Instead, focus on consistent contributions and think about your long-term goals.

That's it! You've taken the core first steps on your investment journey. Remember, consistency is key, and with the right approach, you're set for financial growth.

Do you have any specific questions or need further guidance on any part of the investment process? Share in the comments below!