Navigating Your First Real Estate Investment: Insights and Tips

Learn how to start real estate investing with any credit score!

Ever thought about dipping your toes into real estate investing but unsure if your credit score holds you back? Whether your credit is fabulous or needs a lot of love, there's still a path forward.

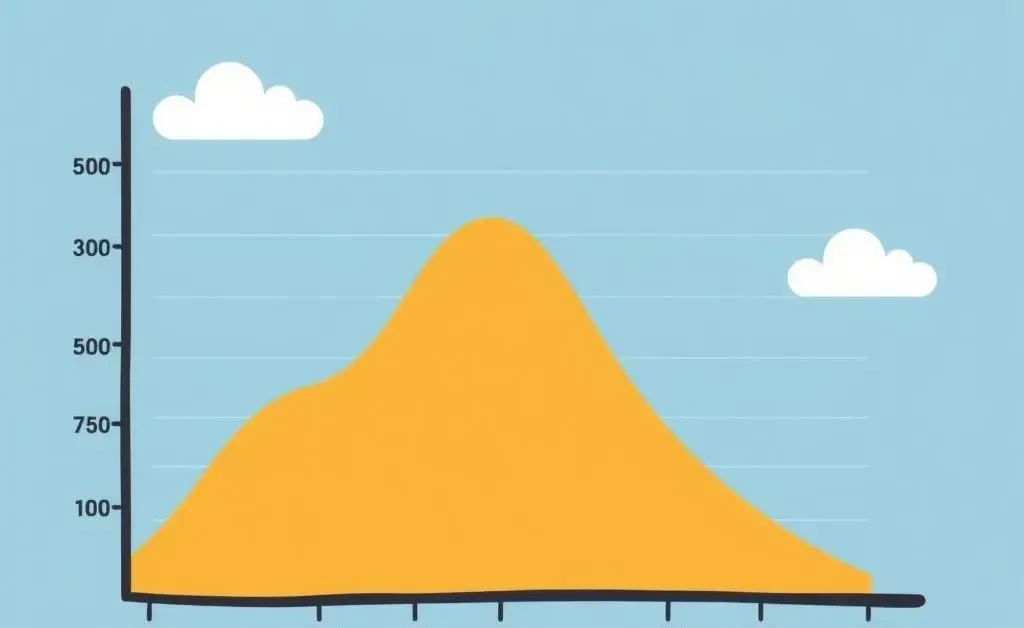

Understanding Your Credit Score

Your credit score might feel like a daunting number, but it's really just a way to gauge your borrowing power. Scores typically range from 300 to 850.

A good score (around 700 or more) is always a plus, but if you're less than perfect, don't despair. There are ways to invest in real estate even with a less-than-ideal score.

Start on the Right Financial Foot

Before diving into real estate investing, it's crucial to have a sound financial foundation. Here's a quick list of steps to begin:

- Assess Your Budget: Know your financial limits and set a realistic budget.

- Improve Your Financial Health: Address outstanding debts and consider consolidating if needed.

- Build a Savings Buffer: Aim for an emergency fund to cover unexpected expenses.

Credit Score Not Perfect? Here Are Some Options

If your credit score isn't top-notch, consider these alternatives:

FHA Loans

These government-backed loans are designed for first-time buyers and those with lower credit scores. They typically require a lower down payment and have more lenient credit requirements.

Find a Partner

Team up with someone with a better credit score. This partnership can open doors that would otherwise be closed due to a low score.

Private Lenders

Consider private lenders. They might focus more on the property's potential rather than your credit score. But do pay attention to their rates and terms.

Real-Life Story

Let me share a relatable story. Meet Lisa, who started her real estate journey with a credit score in the low 600s. She felt stuck, but instead of giving in, she followed some key steps. By focusing on paying off small debts and increasing her down payment savings, she secured an FHA loan and purchased her first property in just two years. Today, Lisa's on her third property!

Conclusion

Remember, real estate investing is a journey, not a sprint. Your current credit score is just a snapshot in time and can always be improved. What's your biggest hurdle with starting in real estate investing?