Practical Steps to Achieve Financial Freedom

Discover proven tips to become financially free and manage your debt with confidence.

Have you ever dreamed of living a life where money is no longer a constant stressor, but instead a tool for freedom and creativity? Let’s dive into some practical, proven steps to help turn that dream into reality.

Where to Begin on the Path to Financial Freedom

Embarking on a journey to financial freedom might feel like a daunting task. However, starting small and staying consistent can lead you to achieve big results over time. The key is to identify and implement effective strategies that fit your lifestyle and goals.

The Importance of Setting Clear Financial Goals

Setting clear and achievable financial goals is crucial. Imagine this: You’re at your favorite coffee shop, sipping a latte and writing down your financial goals for the year on a small notepad. Planning makes everything feel more tangible, doesn’t it?

- Make a list of short-term and long-term financial goals.

- Define what financial freedom looks like for you.

- Keep your goals visible—stick them on your fridge or in your wallet.

Tackling Debt with Confidence

Debt is often the biggest hurdle to achieving financial freedom. But don't worry—overcoming it is entirely possible with a strategic approach.

Start by identifying all your debts and understand the interest rates for each. Consider adopting the snowball method, where you focus on paying off the smallest debts first while making minimum payments on larger ones.

This not only helps to reduce the number of debts but also gives you psychological wins that motivate you to keep going. Think of it like climbing a mountain: Each step forward builds your confidence to reach the top.

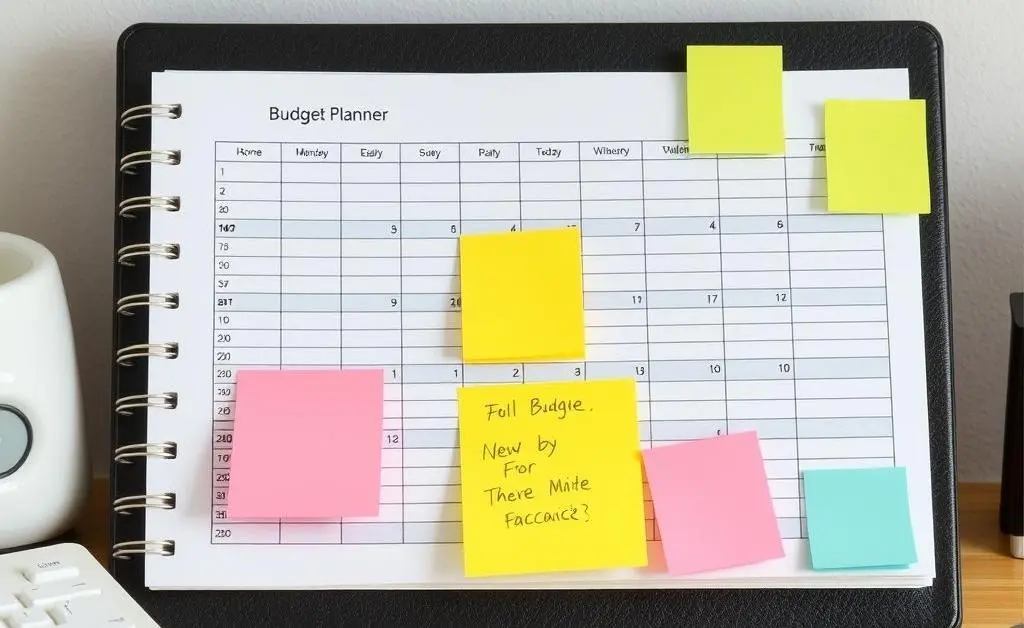

Smart Budgeting and Saving Tactics

Effective budgeting is the backbone of financial stability. It’s like the navigation system ensuring you're on the right path. One quick tip: Always save a portion of your income before spending.

Here's a simple tactic:

- Use the 50/30/20 rule: Allocate 50% of your income for needs, 30% for wants, and 20% for savings.

- Automate your savings to avoid temptation and ensure consistency.

- Regularly review your budget to accommodate any changes in your financial situation.

Investing in Your Future

Investing can be intimidating, but starting small makes a big difference over time. Consider opening a retirement account or investing in index funds that diversify your risk while providing a steady return.

Picture someone relaxing with a tablet, checking their investments surrounded by the tranquility of greenery—it’s the calm assurance of a secure financial future.

The Emotional Aspect of Financial Freedom

Achieving financial freedom is as much an emotional journey as it is a financial one. Celebrating small victories and keeping a positive mindset are crucial. Just like in that coffee shop moment—surround yourself with things that inspire and remind you of your progress.

End your day by reflecting on one thing you are grateful for about your financial journey. This practice not only boosts motivation but also promotes a healthier relationship with money.

So, what does financial freedom mean to you? Perhaps it’s traveling the world or simply having peace of mind. Whatever it is, take consistent steps to make that vision a reality. Have any unique tips you’d love to share on achieving financial freedom?