Protect Your Debit Card from Fraud: Simple Steps You Can Take

Discover practical tips to secure your debit card from potential fraud and unknown charges.

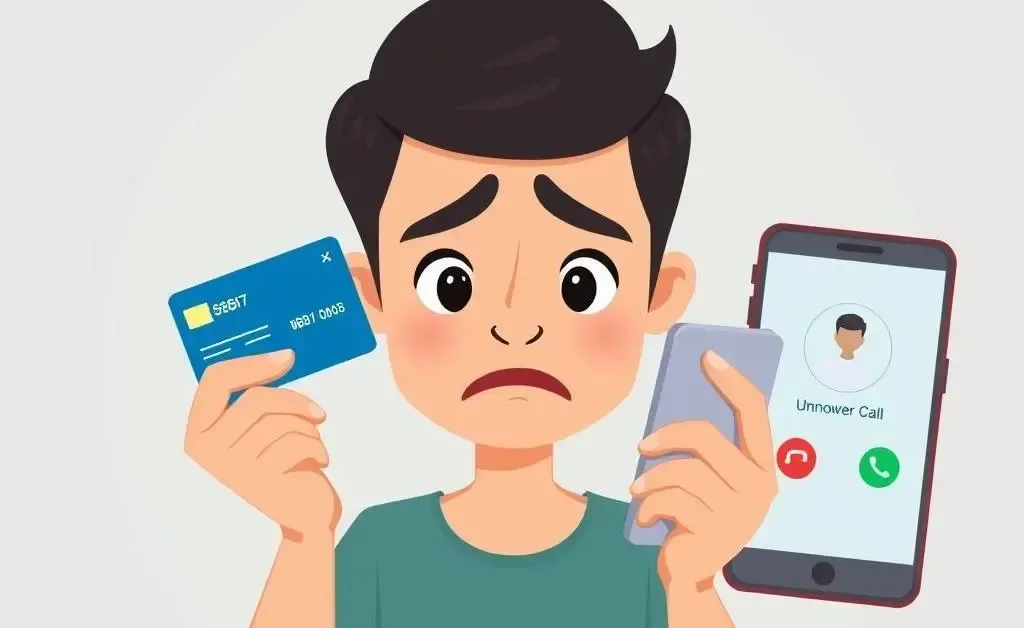

If you’re like most people, you use your debit card almost every day. It’s convenient, right? But what happens when you see an unknown caller ID related to your debit card or notice strange charges piling up? Let’s dive into how you can protect your debit card from potential fraud.

Understanding Debit Card Fraud

First things first: debit card fraud happens when someone gets access to your card details and uses it without your permission. This can lead to unauthorized withdrawals or purchases. Scary, isn’t it?

How to Spot Potential Fraud

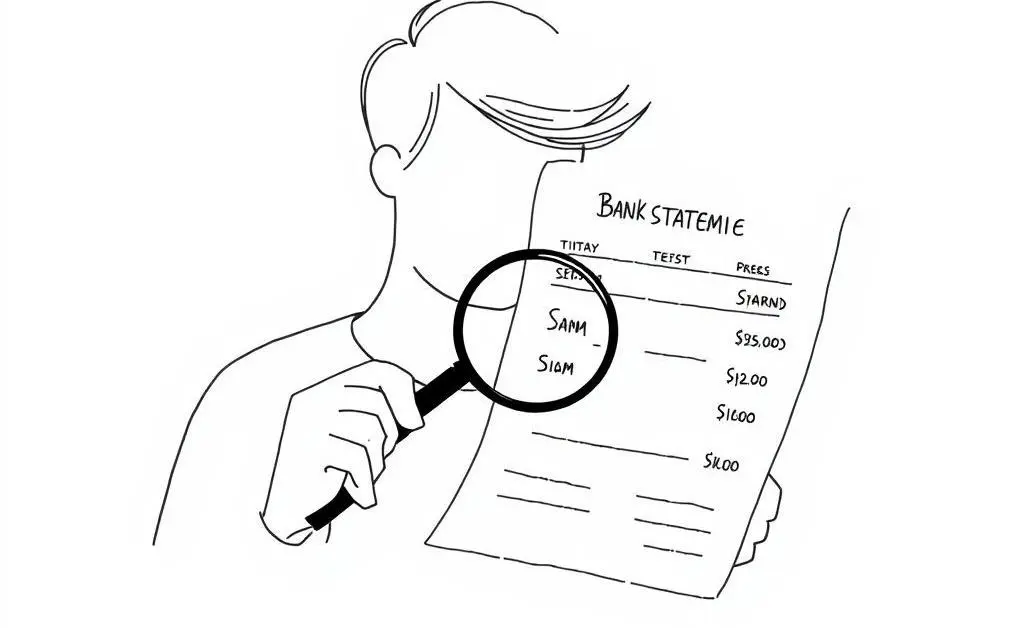

Ever noticed an unknown caller ID related to your debit card? That can be a sign. Similarly, unexpected charges on your statement should raise a red flag.

Steps to Take Immediately

- Don’t panic! Verify the charges or calls first—mistakes can happen.

- Contact your bank’s customer service. They can help confirm if the call or charge is fraudulent.

- Consider freezing your card temporarily until the issue is resolved.

Preventive Measures You Can Implement

Now, let’s talk prevention. No one wants to deal with fraud, so here’s how you can safeguard yourself:

- Monitor Your Accounts: Regularly check your bank statements and account details online to spot anything odd.

- Be Skeptical of Unknown Calls: If you receive a suspicious call, don’t provide sensitive information. Hang up and call your bank using the number on the back of your card.

- Utilize Bank Alerts: Set up account alerts to get SMS or email notifications for transactions.

Why Staying Vigilant Matters

Keeping an eye on your financial health can save you from headaches down the line. Plus, resolving debit card fraud quickly is crucial to prevent financial loss.

Have you ever dealt with potential fraud? What measures did you find most effective? Would love to hear your thoughts or tips in the comments!