Reaching Your First $100K: A Journey Through Financial Independence

Explore practical steps to accumulate your first $100K swiftly and smoothly.

Achieving your first $100K can feel like nearing the summit of a financial mountain. Whether you're just setting out on your financial journey or already have a few steps behind you, getting that first six-figure balance involves strategy, patience, and a splash of perseverance. Let's explore how you can reach this milestone and why it truly makes a difference.

Why the First $100K Matters

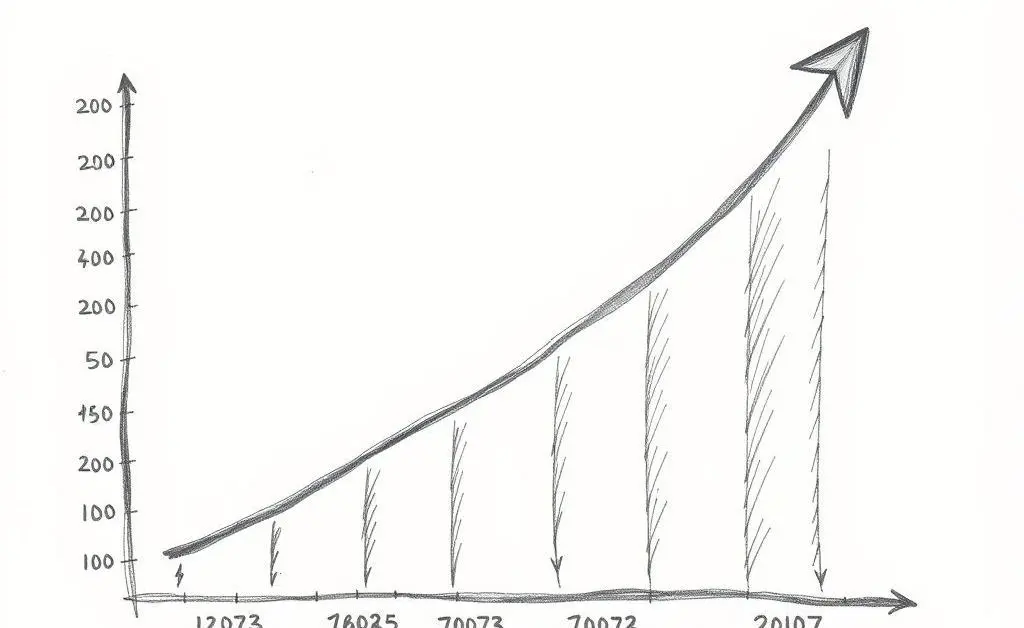

The $100K mark is often dubbed both a significant financial milestone and a powerful motivator. Beyond just numbers, it represents an achievement in saving and investing discipline. The legendary investor Charlie Munger once coined it as "the hardest part" due to the compounding magic it unlocks thereafter.

Start with a Solid Budget

Building your first $100K begins with understanding your income and expenses. Creating a practical, flexible budget is like drawing a treasure map but with money!

Here are some quick tips to streamline your budget:

- Track all expenses using a budgeting app or notebook.

- Identify non-essential spending to trim.

- Set up automatic transfers to your savings.

Invest Smartly and Start Early

Investing is a core pillar in your quest to $100K. By leveraging the power of compound interest, your investments can work harder, not you.

Investment Options to Consider

- 401(k) or IRA for tax-advantaged growth.

- Low-cost index funds for stable returns.

- Real estate, if you're ready for an active investment role.

Remember, it's not about earning huge returns immediately but being consistent.

Mindset and Goals: Fuel for Your Journey

This isn't just about financial strategies; it's a mental roadtrip too. Celebrate small victories and stay motivated by visualizing the freedom and security that come with financial independence.

Set clear goals like:

- Milestones every $10K to keep momentum.

- A debt repayment plan, if necessary.

- A 'why'—your big reason for saving.

The Takeaway: Your Financial Freedom Awaits

Reaching your first $100K isn't a mere financial target; it's a gateway to more ambitious opportunities. Each dollar saved and invested propels you closer to financial independence, providing peace of mind and the freedom to choose your life's path.

Where are you in your journey to $100K? What strategies have worked for you? Feel free to share your experiences in the comments below!