Refinancing Your Mortgage with Confidence: A Practical Guide

Explore how to refinance your mortgage confidently and manage collections successfully.

How do you feel about your mortgage? It can be a bit like a relationship: it starts with excitement but occasionally, some bumps in the road appear. If you’re considering refinancing, you might be feeling a mix of hope and anxiety. Why refinance? Maybe you’re chasing a lower interest rate, need money for a big project, or want to pay down some debts.

What is Mortgage Refinancing?

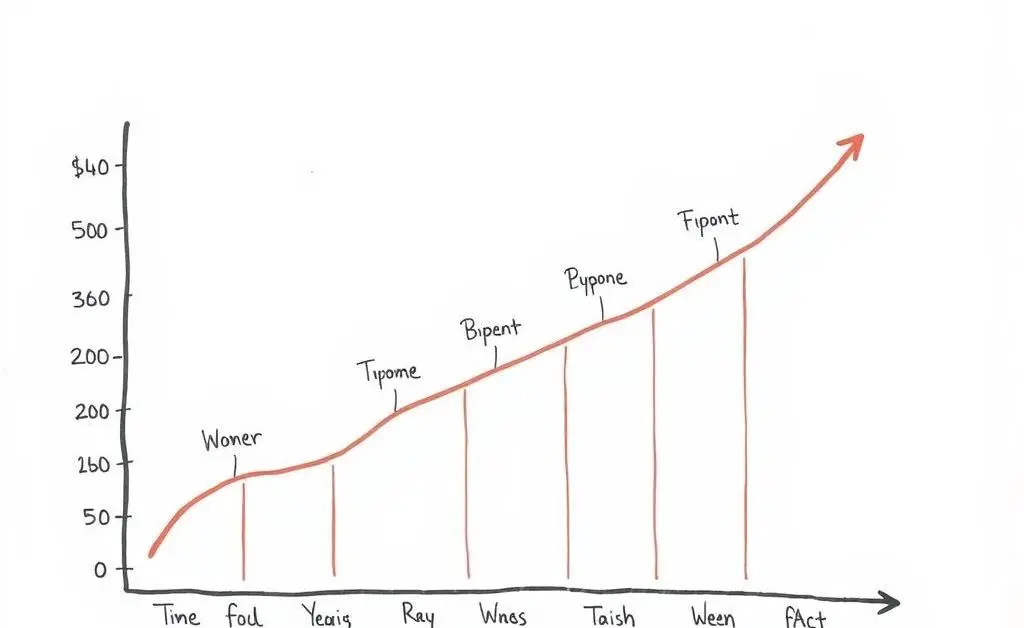

Mortgage refinancing is essentially replacing your existing mortgage with a new one, typically to secure better terms. The idea is to adjust the mortgage interest rate, the monthly payments, or the length of the loan. The primary keyword here is mortgage refinancing, which allows you to potentially save hundreds or thousands over the lifetime of your loan.

Why Consider Refinancing?

- Lower Interest Rates: Even a small reduction can make a big difference over 15 or 30 years.

- Debt Consolidation: If you have high-interest debts, you can roll these into your mortgage, which might reduce expenses.

- Home Equity Usage: It’s like giving yourself a cash advance by leveraging higher home equity.

Refinancing can feel like getting a fresh start. Just imagine making financial decisions with confidence, like that moment you manage to score a fantastic home internet deal—except it’s your mortgage!

Managing Collections and Credit

If your credit is less than stellar, collections simplifying your finances and paying off bad debts could be beneficial. Speak with your creditors or consult a financial advisor to create a strategy that works for you. Ensuring solid credit health before refinancing is like tidying up a garden before planting new seeds.

Steps to Confident Refinancing

Here are some steps to navigate your mortgage refinancing with confidence:

1. Evaluate Your Financial Goals

What do you want to achieve through refinancing? List your goals. This will guide your decisions every step of the way.

2. Check Your Credit Report

Ensure there are no errors and your score is healthy. A little tidying up can lead to better refinance terms.

3. Compare Lenders

Don’t rush with the first offer. Shop around to find the terms that work best for you, just as you would with any big purchase.

4. Ready Your Documents

Gather employment proof, tax returns, credit report, and existing mortgage details. It’s about being prepared at every stage of this financial journey.

Conclusion: Your Financial Journey

Refinancing can be a critical move in your financial journey, paving the way for long-term savings and improved cash flow. Take the time to research, plan, and execute wisely. What do you dream of achieving with your refinancing? Share your thoughts below; I’d love to hear your goals!