S&P 500 vs. NASDAQ 100: Making the Right Investment Choice for You

A friendly guide to choosing between the S&P 500 and NASDAQ 100 for your investment goals.

When it comes to investing in the stock market, choosing the right index to invest in can be a daunting task. Two popular choices are the S&P 500 and the NASDAQ 100. Whether you're a seasoned investor or a newcomer, understanding these indices will help you make an informed decision that aligns with your financial goals.

Understanding the Basics of the S&P 500 and NASDAQ 100

The S&P 500 is composed of 500 of the largest publicly traded companies in the United States. It's a strong indicator of the overall health of the U.S. stock market and economy. On the other hand, the NASDAQ 100 includes 100 of the largest non-financial companies, known for its tech-heavy lineup, including giants like Apple and Microsoft.

Key Differences and Why They Matter

The most significant difference between the two indices is sector composition. The NASDAQ 100 has a significant focus on technology and innovation-driven companies, meaning it's more volatile yet offers potentially higher growth. If you're someone who can withstand short-term fluctuations for potentially higher long-term gains, NASDAQ 100 might catch your fancy.

In contrast, the S&P 500 is more diversified, encompassing sectors like healthcare, finance, and consumer goods. This diversification tends to make it less volatile, which could be a safer option for cautious investors.

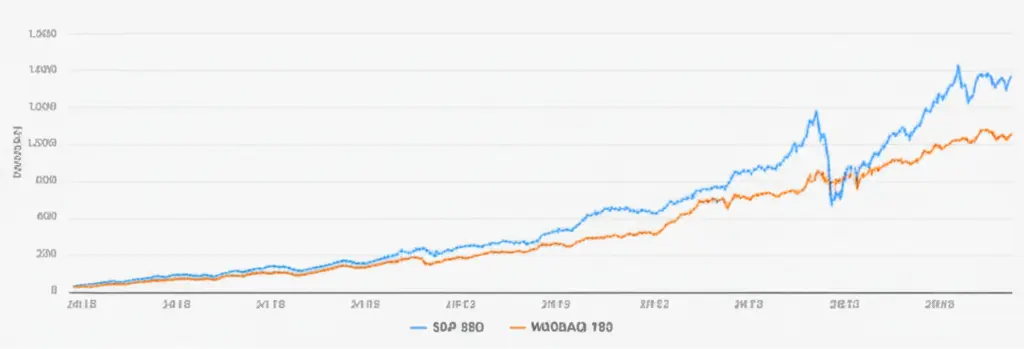

Performance Over Time

Both indices have their periods of triumphs and trials. Historically, the NASDAQ 100 has outperformed the S&P 500 during bull markets, driven by its tech-heavy composition. Meanwhile, the S&P 500 often shows resilience during market downturns due to its balanced nature.

Explore more about stock market indices

Choosing the Right Index for Your Goals

Your personal investment strategy should reflect your risk tolerance, financial goals, and investment timeline. If you're younger and open to risk, leaning toward the NASDAQ 100 could maximize your returns. However, if you prefer stability and incremental growth, the S&P 500 might be more suitable.

The Final Takeaway

The choice between S&P 500 and NASDAQ 100 boils down to your individual goals. Neither one is objectively better; it all depends on whether you value growth over stability or vice versa. As always, consult with a financial advisor to tailor decision-making to your specific situation. What are your thoughts on these indices? Do you lean towards the steady S&P 500 or the dynamic NASDAQ 100?