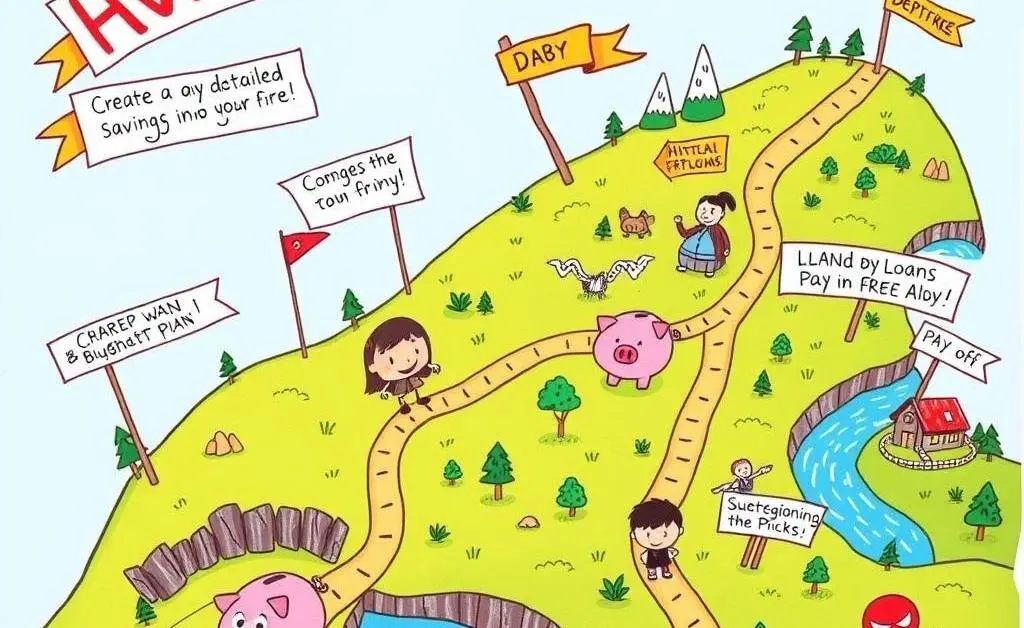

Say Goodbye to Debt: A Friendly Approach to Financial Freedom

Discover practical steps to tackle debt and achieve financial stability with ease.

Say Goodbye to Debt: A Friendly Approach to Financial Freedom

Ever felt like your financial life is stuck in the mud? You’re not alone! Tackling debt can feel like a never-ending battle, but it doesn't have to be that way. Believe it or not, there are friendly steps you can take to start paving the way to financial freedom today.

Understand Where You Stand

The first step of any journey is to understand your starting point. Ask yourself, How much do I really owe? Review your financial statements to get a clear picture of your debts, including credit cards, student loans, and any other liabilities.

Create a Realistic Budget

Let’s face it, budgets are like diet plans—they only work if you stick to them. Start by tracking your income and expenses to see where your money is going. Use a simple spreadsheet or a budgeting app, whatever suits you best.

- List all monthly income sources.

- Track fixed expenses (like rent and utilities).

- Estimate variable expenses (like groceries and entertainment).

One fictional friend of mine, let’s call her Sarah, turned her finances around by simply listing her expenses at a local coffee shop every Sunday. This routine not only helped her budget better but made financial planning seem less like a chore and more like a catch-up session with herself.

Tackle Debt Strategically

Now that you have a budget, it’s time to decide on the best strategy to tackle your debt. There are different approaches depending on what suits you best.

Snowball vs. Avalanche Method

With the Snowball Method, you focus on paying off your smallest debts first. This can provide quick wins and motivate you to keep going. Alternatively, the Avalanche Method prioritizes debts with the highest interest rates, which can save you money in the long run.

Choose the method that resonates with you and commit to it. Remember, the key is to keep moving forward, even if it’s just one step at a time.

Celebrate Your Successes!

Every milestone achieved is worth celebrating. Paid off a credit card? Treat yourself to a small victory—a favorite dessert or a movie night at home. Celebrations are vital to keeping your morale high.

Conclusion: Keep Pushing Forward

Achieving financial freedom is a marathon, not a sprint. Stay focused on your goals and keep revisiting your plan to adjust as needed. How do you keep yourself motivated in reaching your financial goals? Share your thoughts below—we’d love to hear your story!