Secrets to Boosting Your Credit Score to 800 and Beyond

Achieve an 800 credit score with practical tips and strategies. Learn steps to improve credit health.

Ever wondered what it feels like to join the 800 credit score club? It's not just about the bragging rights, though those are nice too. An 800+ score can unlock a world of financial possibilities, from lower interest rates to exclusive credit card offers. But how exactly do you get there? It might seem daunting, but with a little patience and strategic planning, you'll find it's not just a dream.

Why is a Good Credit Score Important?

Your credit score isn't just a random number; it's a reflection of your financial health. A high credit score can lead to:

- Lower interest rates on loans and credit cards

- Better insurance premiums

- Increased bargaining power

- More housing options

Simple Habits for Credit Score Success

Here's a relatable story: Imagine your credit score is like a garden. The seeds are your initial financial decisions, and regular care includes watering (paying bills on time) and weeding out bad habits (keeping credit low). My friend Sam started with a score in the 600s. Sam religiously followed these practices and in three years, hit the magic 800 mark! So what was the secret?

1. Pay On Time, Every Time

Payment history is one of the biggest factors in credit score calculations. Treat your due dates like birthday celebrations; never miss them!

2. Keep Your Credit Utilization Low

Try to keep your credit card balance below 30% of your limit. It’s like staying below the speed limit—it keeps you safe and efficient.

3. Mix Up Your Credit

Having a mix of credit forms—credit cards, loans, etc.—can positively impact your score. Just like a balanced diet, diversity in credit is healthy.

4. Give Mistakes Time to Heal

Negative marks won't last forever. Focus on building new, positive habits. Time is your ally.

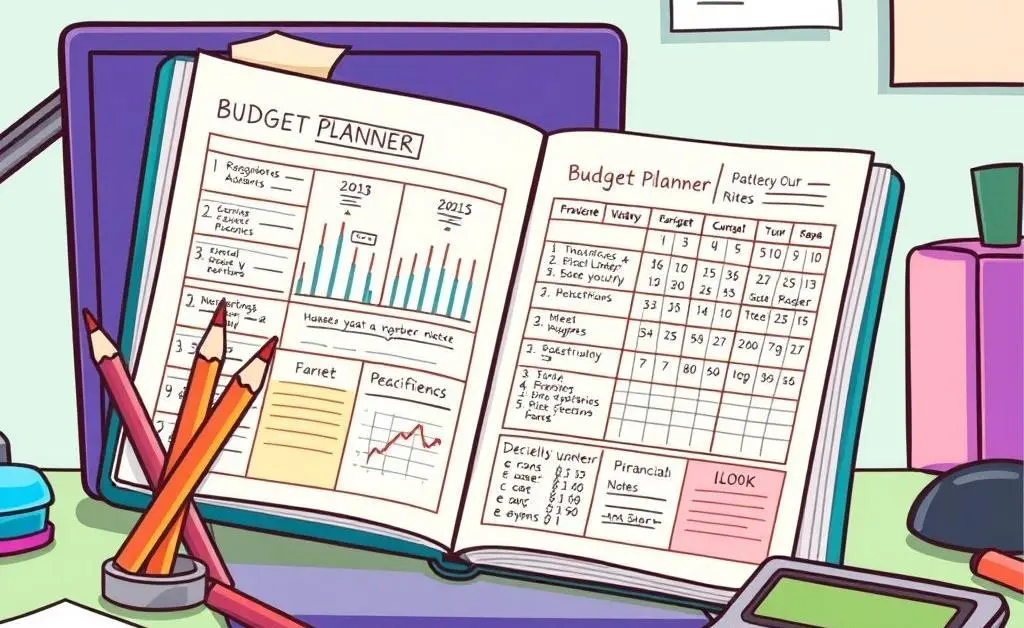

Budgeting for Credit Score Gains

Budgeting isn't just about saving money. It's a tool to help you manage debt effectively, which positively impacts your score over time. Use budget planners like NerdWallet for guidance.

The Road Ahead

Remember, improving your credit score is a marathon, not a sprint. Consistency is key. Celebrate small wins along the way! Are you ready to take the first step towards an 800 credit score? What’s your next financial goal?