Should You Replace Your Paid-Off Car? Here's What to Consider

Deciding between keeping or replacing your car? Let's explore what factors matter most.

The Big Decision: Keep or Replace Your Car?

If you're wondering whether to keep your trusty old vehicle or trade it in for something shiny and new, you're definitely not alone. It's a situation many of us face, especially when our car loans are paid off, and it's time to decide what comes next. In this post, I'll take you through the factors that could influence this decision, with practical insights and a sprinkle of personal anecdotes.

Why Keeping Your Old Car Could Be a Smart Move

There's something comforting about a car you know inside out. It's like an old pair of shoes - comfortable and familiar.

- Reliability: If your car is a reliable companion with a record of minimal issues, why fix what isn't broken? Regular maintenance can keep it running smoothly and delay major repairs.

- Sentimental Value: Sometimes, it's not just about money. The memories attached to that vehicle can be invaluable.

Cost Savings: No loan payments mean more cash in your pocket. You may have noticed your savings growing without that monthly car note. Plus, keeping your car lowers your insurance rate.

When It's Time to Consider a New Ride

Then again, the allure of a new car smell and upgraded features can be tempting. Here are a few signs that maybe it's time to drive something new off the lot.

- Safety Concerns: Newer models come with advanced safety features that your old car might lack. Consider these features an investment in your safety and peace of mind.

- Fuel Efficiency: Older cars can become gas guzzlers. Modern vehicles often offer better fuel economy, which might balance out the monthly payments with savings at the pump.

Frequent Repairs: If repair costs exceed the car's value or if you're on a first-name basis with your mechanic, it might be time to move on.

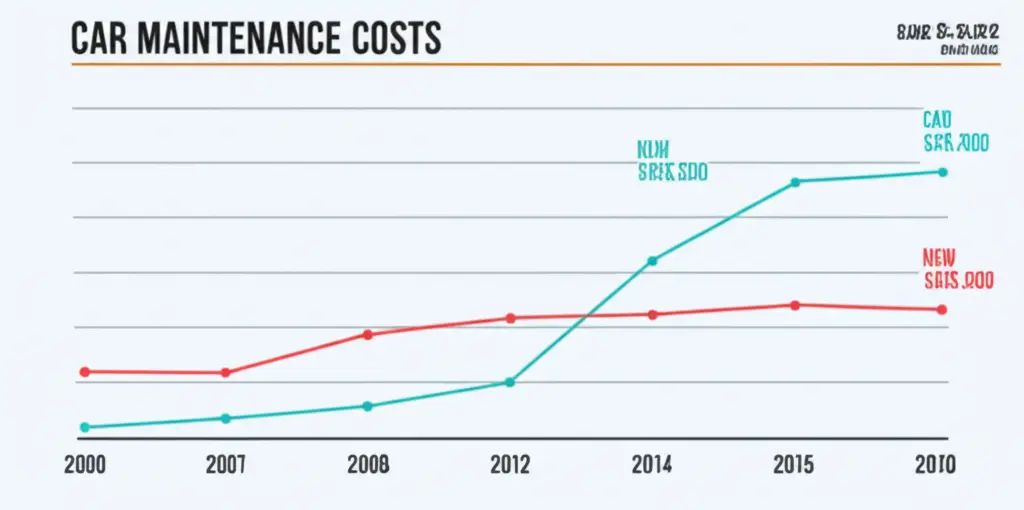

Crunching the Numbers: A Financial Perspective

Ultimately, the decision often boils down to numbers. Let’s do a quick cost-benefit analysis.

Consider this: Maintaining your current car might cost you in repairs, but compare that to the cost of a new car. Factor in car payments, insurance, registration, and additional costs.

Break-even Point: Look at how long it would take for the expenses of a new car to equate the costs associated with your old one. This clarity can often point you in the right direction.

Conclusion: Weighing Your Needs and Preferences

Deciding to keep or replace your car is a personal choice influenced by your financial situation, lifestyle, and personal values. Do you value financial freedom more than the latest tech? Or does the thought of monthly car payments make you wince? Weigh the pros and cons, crunch the numbers, and listen to what makes the most sense for you.

I’d love to hear from you! Have you faced a similar decision? What did you choose, and how did it work out? Share your thoughts in the comments below!