Should You Sell Your Home to Invest the Equity? Here's What to Consider.

Deciding to sell your house for investment? Learn key factors to make an informed choice.

So you've built up a nice chunk of equity in your home, and now you're wondering, "Should I sell to invest elsewhere?" Whether you're eyeing the stock market, considering a rental property, or simply exploring your options, this decision is no small feat. But don't worry, I'm here to walk you through the key factors to consider when deciding what to do with your home equity.

Understanding Home Equity

Let's start with the basics. Home equity is essentially the market value of your home minus any outstanding mortgage loans. It's the financial backdrop that sets the stage for your decision. Knowing exactly how much equity you have is the first step to making a well-informed choice.

Is Selling Your Home the Right Move?

Now, the immediate question: Should you sell your home? Most people consider selling when they believe they can get a significant return on investment. However, selling comes with its own set of costs and challenges.

- Transaction costs: Selling isn't free. Real estate agent fees, closing costs, and moving expenses can quickly add up.

- Market conditions: Selling in a buyer’s market might not give you the return you expect.

- Emotional factors: Don’t underestimate the emotional connection you may have to your home.

Exploring Investment Opportunities

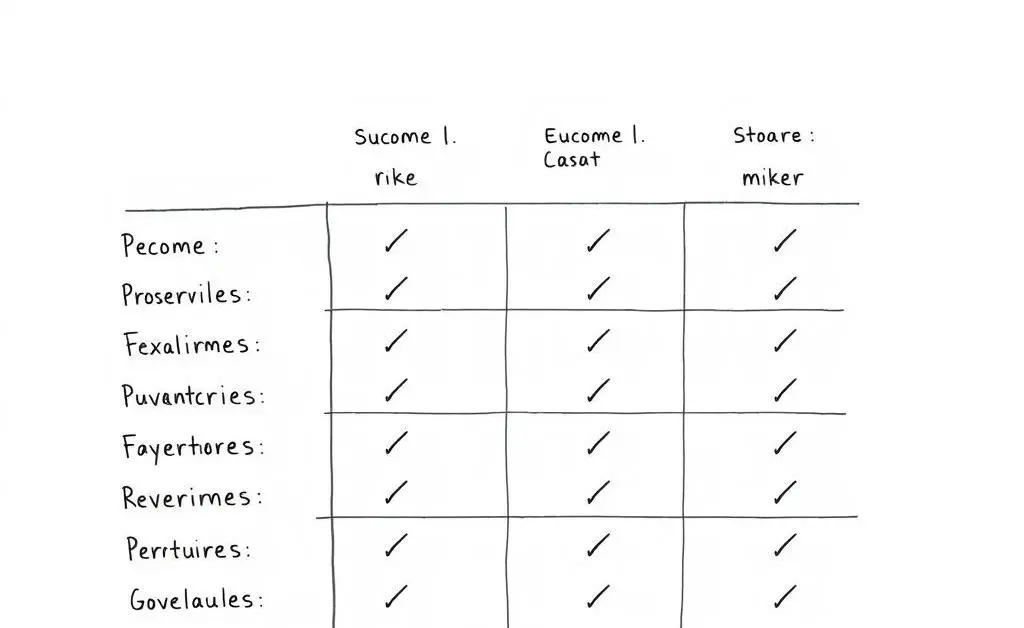

Let's say you do decide to sell. What next? There are multiple paths you could take with your newfound liquidity.

These options range from traditional stock market investments to high-return real estate ventures. Your decision will depend largely on your risk tolerance, financial goals, and investment timeline.

Keeping Your Home and Renting It Out

Not ready to part with your home? Renting out your home could be an enticing alternative that lets you continue to build equity while generating some rental income. However, you’ll need to consider the responsibilities of being a landlord and the viability of the rental market in your area.

Crunching the Numbers

If you’re a numbers person (guilty as charged), doing a deep dive into the financial implications is essential. This means considering the capital gains tax implications, any ongoing costs, and potential future appreciation of your home. While numbers won’t tell you everything, they are certainly a crucial part of this decision.

Consulting the Pros

Finally, talking to a financial advisor can provide tailored insights specific to your situation. They can assist in aligning your decision with your broader financial goals, making sure you're on the right path.

The Takeaway

Deciding whether to sell your house to capitalize on its equity isn't easy, but weighing these factors will get you one step closer to a decision that aligns with your financial goals. After all, it's important to remember that you're in the driver’s seat here; there’s no one-size-fits-all solution. What's your next move going to be?