Simplifying Investments: Key Concepts from the Bogleheads Philosophy

Discover the Bogleheads philosophy to simplify investment strategies and achieve financial freedom.

Hey there! Today, I'm diving into something that might just change the way you think about investing. Have you ever felt overwhelmed by the sheer complexity of financial markets? Trust me, you're not alone. That's why the Bogleheads philosophy resonates with so many of us looking to cut through the noise and manage investments wisely.

What is the Bogleheads Philosophy?

At its core, the Bogleheads approach offers a straightforward guide to building wealth over time without the stress of trying to outsmart the market. It's all about simplicity, patience, and focusing on index funds. The principle is straightforward: by buying and holding low-cost index funds, you can capture the market's overall growth without taking on excessive risk or paying exorbitant fees.

Why Focus on Index Funds?

So why index funds, you ask? They offer broad diversification across industries and sectors, which helps minimize the risks associated with investing in individual stocks. Plus, they come with some of the lowest expense ratios in the investment universe. Famous for being promoted by John C. Bogle, founder of Vanguard Group, these funds are about as close to a 'set it and forget it' strategy as you can get.

Practical Steps to Start Your Boglehead Journey

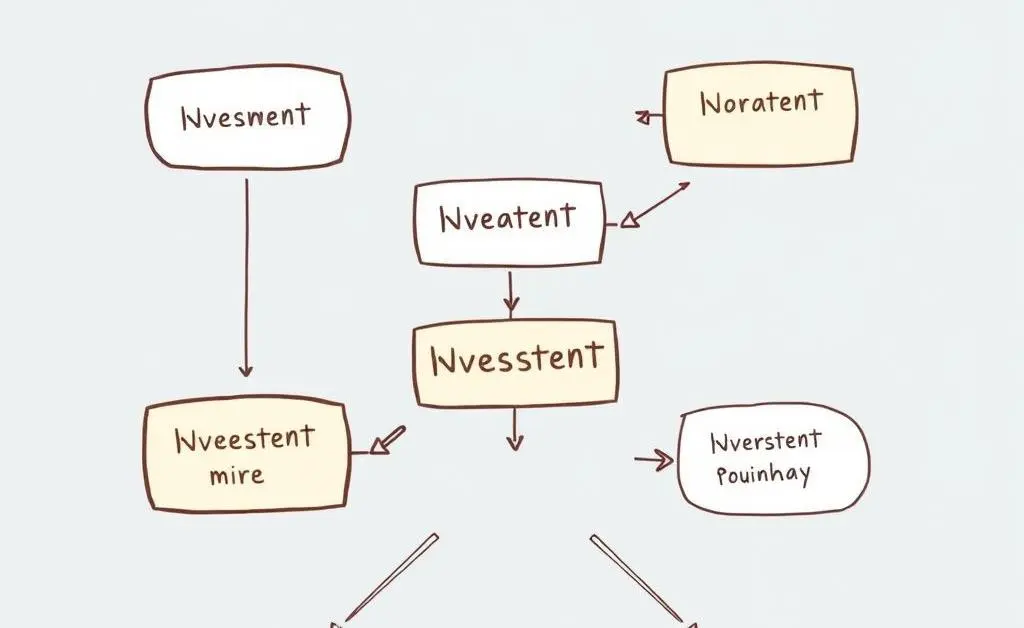

If you're ready to jump on board, here's a practical roadmap:

- Set Clear Financial Goals: Before investing, define what you want to achieve. Is it retirement, a house, or an emergency fund?

- Create a Budget: Track your income and expenses. Ensure you're saving enough to meet your financial objectives.

- Open a Brokerage Account: Choose a low-cost provider that offers access to a wide range of index funds.

- Automate Your Investments: Set up automatic contributions to consistently grow your investment over time.

Tuning Out the Noise

In a world buzzing with hot stock tips and market panic, sticking to the Bogleheads strategy can feel revolutionary. It's virtually impossible to predict market movements consistently, so focusing on what you can control — like costs and diversification — becomes crucial.

Closing Thoughts

By following the Bogleheads philosophy, you’re likely to find a more peaceful and predictable path to financial freedom. Do you have any other investing strategies that simplify your financial life? I'd love to hear about them in the comments below!