Smart Financial Moves: Confidence-Boosting Tips for Beginners

Discover practical steps to boost your financial confidence through budgeting and smart investments.

Hey there! If you’re thinking about getting your financial ducks in a row, you’re not alone. It’s a journey many embark on, often sparked by the desire to feel more confident in their financial future.

Why Confidence in Financial Decisions Matters

Financial confidence can significantly impact your ability to manage money wisely and make informed decisions. It’s not about being fearless; it’s about having the courage to face your financial realities and take control.

The First Step: Know Your Financial Goals

Start by visualizing where you want to be financially in the next 5, 10, or even 20 years. Establishing clear, achievable goals will provide you with direction and motivation. Remember, these goals can be anything from saving for a dream vacation to planning an early retirement.

Mastering the Art of Budgeting

Creating a budget is arguably the most crucial step in gaining financial confidence. But let's be real—it sounds way easier than it is! A successful budget doesn’t restrict you; it frees you! By knowing exactly where your money goes, you make informed decisions about spending and saving.

Steps to Begin Investing Confidently

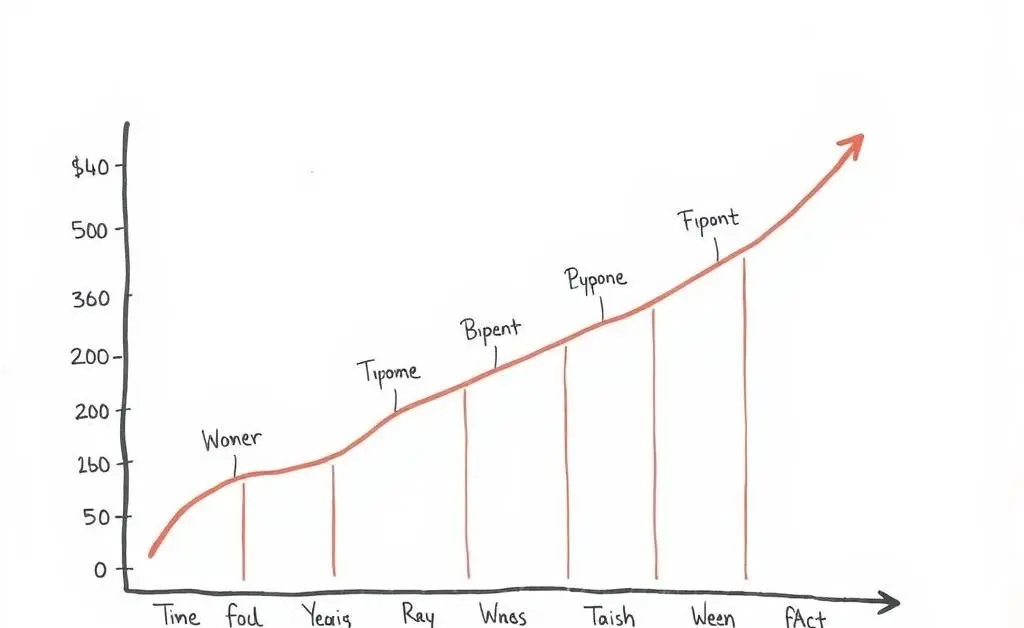

Investing is an excellent way to accumulate wealth over time. Start by educating yourself on investing basics. Understanding different investment options and risks involved is crucial.

Diversify Your Portfolio

Diversification can help spread risk across various assets, balancing your portfolio’s ups and downs. Think of it like a financial safety net. Don’t put all your eggs in one basket!

Consider Your Risk Tolerance

Evaluate how much risk you’re comfortable with. Are you more conservative, or do you have a higher risk tolerance for potentially greater returns? Your risk tolerance should guide your investment strategy.

Building Confidence in Your Financial Journey

Ultimately, confidence in handling finances isn't built overnight. It’s cultivated through continuous learning, practice, and reflection. Start with small steps, and celebrate each milestone along the way.

In Conclusion

Building financial confidence is about more than just numbers; it’s about feeling secure and empowered by the choices you make. As you embark on this path, remember, it’s perfectly normal to feel a bit uneasy at the start. With time and effort, you’ll get there. What will be your first step on this financial journey?