Smart Investment Strategies: Making Sense of Global Index Funds

Explore how to diversify your investment with global index funds. Simple, smart insights explained.

Hey there! If you're as curious about investing as I am, you've probably heard the term 'global index funds' thrown around. But what exactly are these, and how can they fit into your investment strategy? Today, we're going to dive into the world of global index funds and explore how they can benefit your portfolio.

What are Global Index Funds?

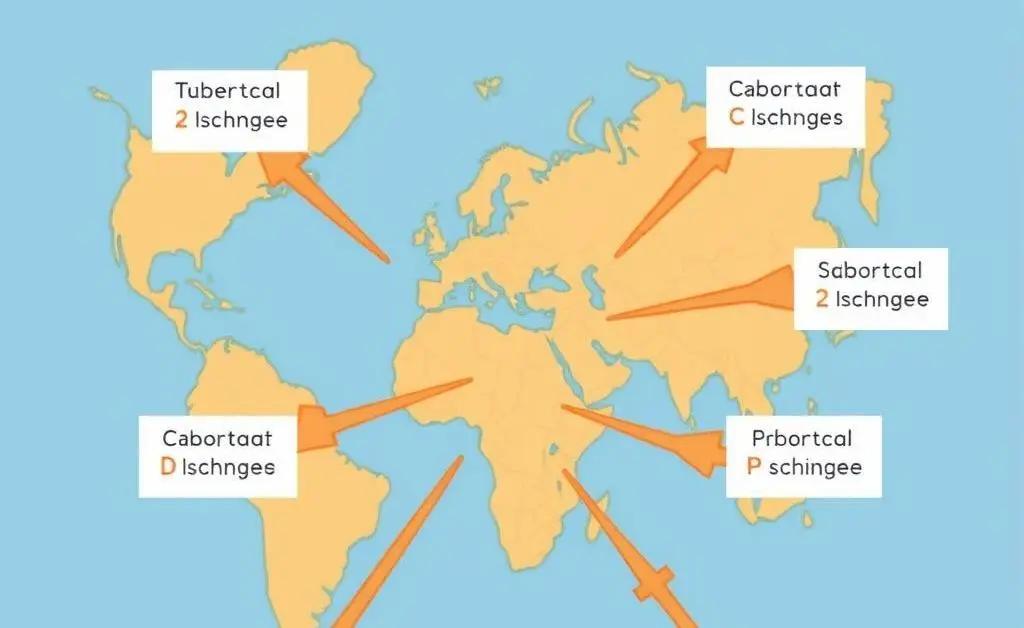

Index funds are a type of mutual fund designed to replicate the performance of a specific index, such as the S&P 500. Global index funds, as the name suggests, aim to mirror global market performance rather than just a specific country's market.

Why Consider Global Index Funds?

Here are some key benefits of investing in global index funds:

- Diversification: By investing globally, you're not putting all your eggs in one basket, which can help mitigate risk.

- Cost-effective: These funds typically have lower fees than actively managed funds, meaning more of your money is working for you.

- Simplicity: Investing in a single fund that tracks a global index is easier to manage than multiple individual stocks.

Think of it as a robust orchestra, where the right mix of instruments (investments) leads to a harmonious symphony (balanced portfolio).

Potential Risks and Considerations

While global index funds offer many benefits, they do come with risks. Currency fluctuations, political instability in emerging markets, and overall economic shifts can impact your returns. It's essential to assess your risk tolerance and long-term investment goals.

How to Get Started

Ready to dive into global index funds? Here are some steps to help you begin:

- Research: Look into different global index funds. Sites like Morningstar can provide valuable insights and performance data.

- Consult: Speak with a financial advisor to ensure your choice aligns with your financial goals.

- Start Small: If you're new, consider starting with a small monthly investment. Many funds allow for low initial investments, giving you a taste of the market without a significant cash outlay.

Investing in global index funds could open up a world of possibilities for your portfolio. It's like taking a trip around the world without leaving your couch—financially speaking, of course! By diversifying your investments, you might find a balanced strategy that suits your needs.

Have you started investing globally yet? I'd love to hear about your experiences or any questions you might have. Let's chat in the comments below!