Smart Money Moves for College Students: Investing Your Savings Wisely

Discover smart ways for college students to invest savings for financial growth.

Ever wondered what to do with those savings you’ve carefully stashed away as a college student? Finding the right way to invest your money can seem daunting when you're balancing classes, work, and the occasional pizza night. But fear not, with a little guidance, you can set your savings on a path to growth.

Start with a Financial Health Check-Up

Before diving into the world of investing, take a moment to assess your financial health. Consider these steps as your money wellness routine:

- Emergency Fund: Aim to have at least three months’ worth of living expenses saved.

- Debt Review: Look at any high-interest debt. Prioritizing paying this off can free up funds for investing.

- Budget Check: Make sure you have a realistic budget in place that allows you to save routinely.

Relatable Investing Strategies for Students

Once your financial foundation is solid, it’s time to consider investing. Let’s explore some beginner-friendly avenues:

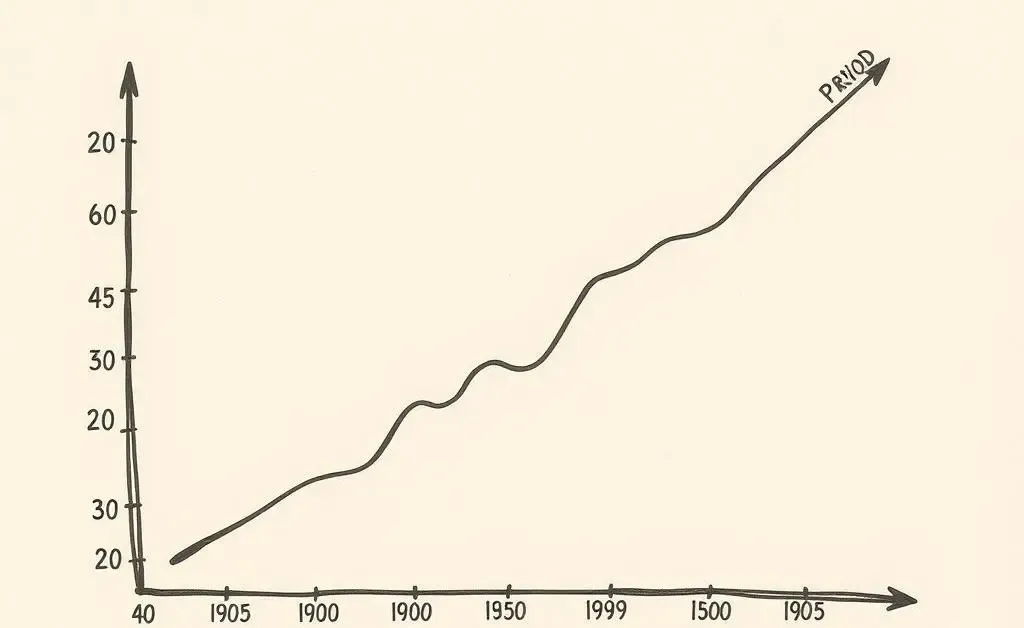

1. Low-Cost Index Funds

These funds are a favorite among young investors for a reason. They offer diversified exposure to the market without needing to pick individual stocks. Plus, the fees are generally lower, leaving more returns in your pocket.

2. Robo-Advisors

If you're keen on hands-off investing, robo-advisors might be your go-to. They use algorithms to manage your portfolio based on your risk tolerance, often requiring low minimum investments.

3. Retirement Accounts

Starting early with retirement savings can hugely benefit you. Look into Roth IRAs, which offer tax advantages later on.

Jenna, a sophomore majoring in biology, decided to dip her toes into the world of investing. Unsure at first, she started with a small monthly contribution to a robo-advisor. A year later, she’s appreciating not just the growth, but also the peace of mind of having a financial plan in motion.

Keep Learning and Adapting

Investing is not a 'set it and forget it' scenario. Keep educating yourself about the financial markets and adjust your strategies as your life changes. There are plenty of free online resources and books that can provide valuable insights.

In Conclusion

Smart investing isn’t reserved for the wealthy—it’s accessible for anyone willing to start small and remain curious. By making informed choices now, you’re setting yourself up for a more secure financial future. What savings strategies have worked for you or someone you know? Let’s start a conversation in the comments below.