Smart Money Moves for Young Adults: A Step-by-Step Guide

Explore practical financial tips for young adults to boost savings and start investing.

Have you ever found yourself wondering, "How can I manage my money better?" If you're a young adult dipping your toes into the world of personal finance, you're not alone. With a myriad of options and opinions, it’s easy to feel overwhelmed. Don’t worry—today, we'll explore a straightforward path to smart money management designed just for you.

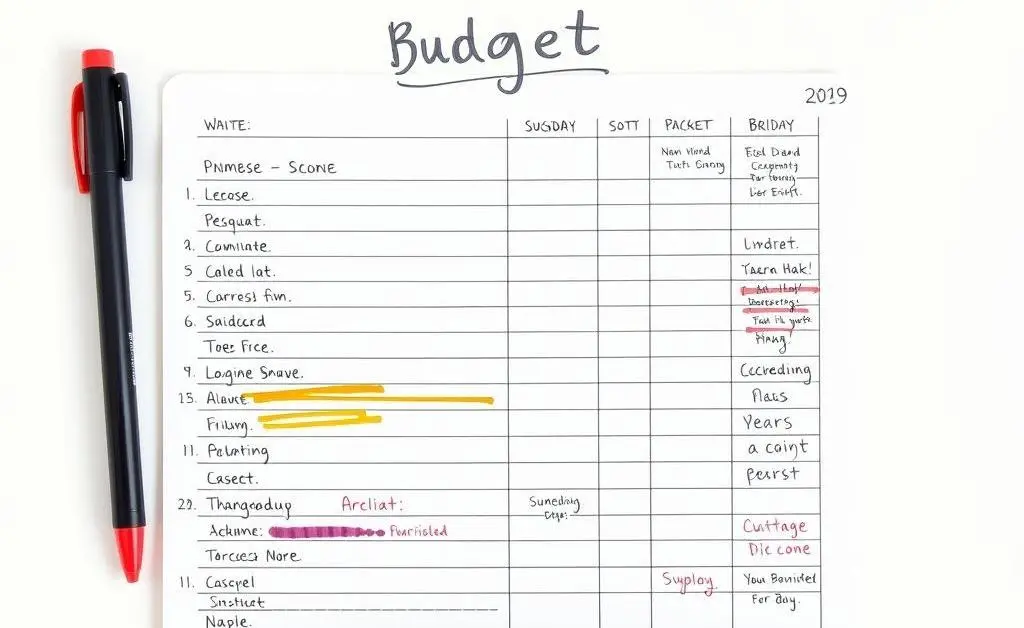

Start with a Realistic Budget

Before anything else, establish a budget. This doesn’t have to be boring or restrictive. Think of it as setting your financial GPS.

- Track Your Spending: Find out where your money is going each month. Use apps or a simple notebook to jot down expenses.

- Set Financial Goals: Want to save for a vacation or pay down student loans? Define your goals to give your budget purpose.

- Adjust as Needed: Stay flexible. If a plan isn't working, tweak it rather than abandoning it altogether.

Boost Savings with an Emergency Fund

Imagine waking up to a flat tire or an unexpected medical bill. An emergency fund is your financial cushion. Aim to save at least three to six months’ worth of expenses. Start small, perhaps $10 a week, and watch your safety net grow.

Dip Your Toes into Investing

When it comes to investing, the key is to start early and let time work its magic. You don’t need a massive bankroll to begin—many platforms allow you to start with minimal investment.

Consider diversifying your portfolio by looking at stocks, bonds, and index funds. Research and seek guidance if needed, but remember, investing shouldn't feel like a trip to the casino.

A Personal Anecdote

Let me tell you about my friend Alex. At 21, he decided to take control of his finances. He started with the 50/30/20 budget rule—50% of his income went to necessities, 30% to wants, and 20% to savings and investments. It wasn't easy at first, but Alex now has a solid emergency fund and has seen a 10% growth in his investment portfolio over two years. His advice? Start small and be consistent.

Takeaway: Your Financial Adventure Awaits

Managing money efficiently is a skill everyone can master with a bit of practice. Begin with budgeting, build a safety net, and explore investments to set yourself on a path to financial success.

What's the first step you’ll take to improve your financial future? Drop your thoughts or questions below!