Smart Money Moves: How Albanians Can Plan for Future Financial Growth

Explore practical financial goals and planning tips for a secure future.

Hey there! It seems like every time I chat with friends from Albania, the conversation eventually turns to money—more specifically, how to make it, save it, and grow it. I get it; planning for the future can be daunting. But trust me, there are some really practical steps you can take right now to set yourself up for financial success. Let's dive in!

Setting Realistic Financial Goals

First things first, let's talk about setting financial goals. You can't get somewhere if you don't know where you're going, right? The key here is to be specific and realistic. Whether that means saving for a dream home, investing in education, or something else entirely—it all starts with clear goals.

Invest in Your Career

One practical way to boost your financial situation is by investing in your career. Whether this means getting additional certification, switching fields, or asking for a raise, your income is one of the most important resources for achieving your goals. Remember, when it comes to skills, you're never done learning!

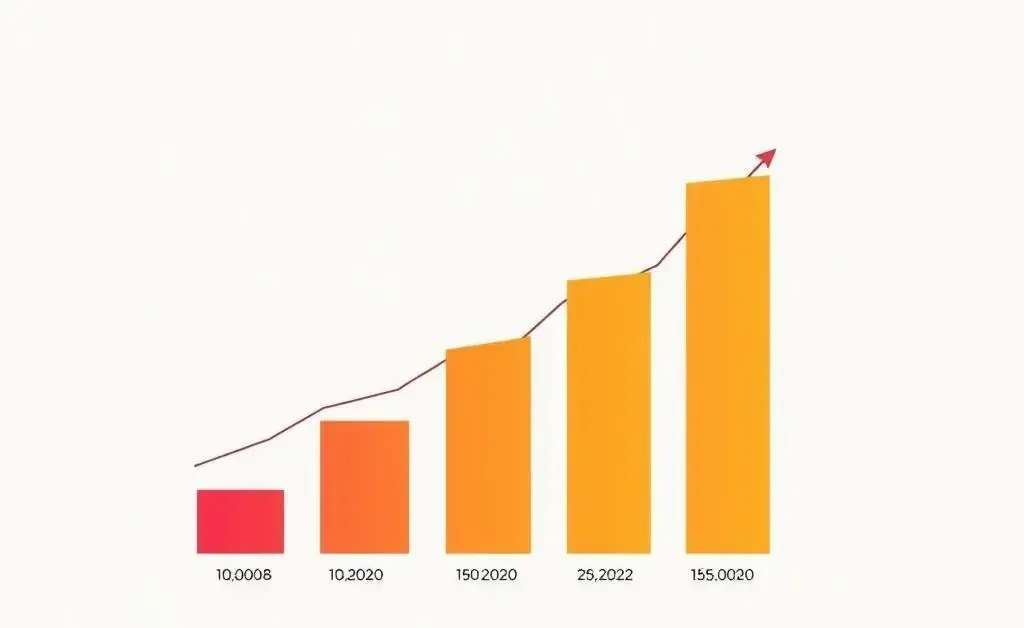

Smart Investment Strategies

Once you've locked in your goals and invested in yourself professionally, it's time to think about investment strategies. I know, the stock market can seem intimidating, but a cautious entry can pay off in the long run. Consider low-risk options to start, like bonds or mutual funds, before diving into stocks or real estate.

Plan for Tolerance and Adaptability

Lastly, stay flexible and adaptable. The best-laid plans of mice and men, and all that. Life could throw you a curveball—maybe an unexpected expense or a sudden change in the job market. A good plan can handle some ups and downs. Keep revisiting and adjusting your goals as you learn more and grow.

In conclusion, while building wealth and ensuring a stable financial future may seem like a massive undertaking, it doesn’t have to be. With clear goals, smart career decisions, and strategic investments, you’re on your way! What's the first step you're going to take? Let me know in the comments!