Smart Ways to Invest a $100K Inheritance at 65

Discover smart strategies for investing a $100K inheritance at 65, focusing on retirement and financial security.

Imagine finding yourself at 65 with a $100K windfall. It sounds like a dream come true, right? However, deciding the best ways to invest this inheritance can be overwhelming. Let's explore some practical strategies for making the most out of this financial opportunity.

Where to Start: Assess Your Situation

Before diving into investment options, it’s essential to assess your current financial situation. Do you have any debts that need your attention? Paying off high-interest debts might be an immediate priority. Also, consider your current income sources, such as pensions or social security, and your monthly expenses.

Set Clear Goals

Everyone's investment goals are different. Are you hoping to grow your wealth to leave a legacy for loved ones, or do you want to supplement your existing income to enjoy a more comfortable retirement? Clearly defining your goals will guide your investment choices.

Diversifying Your Investments: The Key to Security

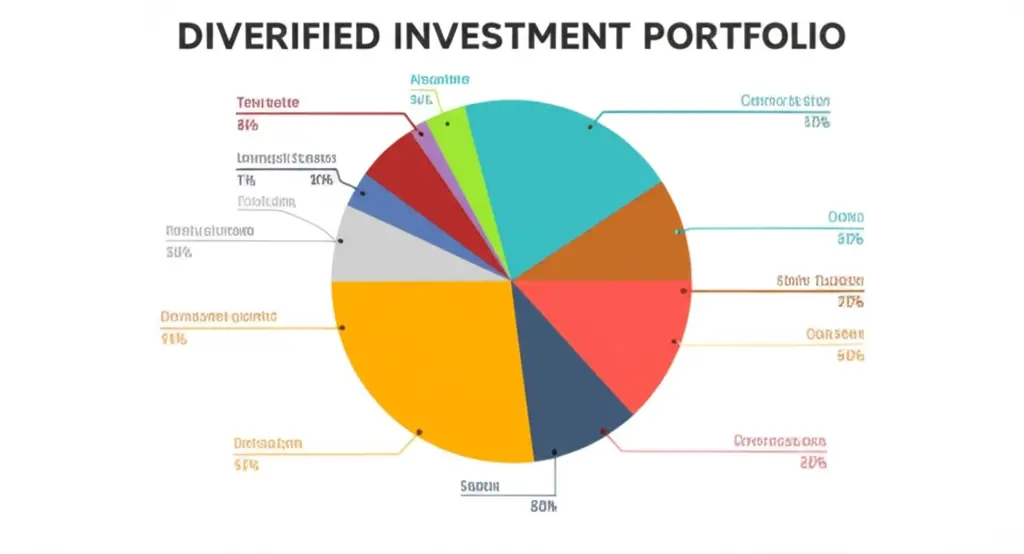

We've all heard the saying, "Don’t put all your eggs in one basket." The same applies to investing. Diversification can help manage risk by spreading your capital across different asset classes.

- Stocks: While they can be more volatile, stocks also offer higher potential returns. Consider a mix of index funds or blue-chip stocks.

- Bonds: Typically more stable than stocks, bonds are a good way to preserve capital and earn a steady income.

- Real Estate: This can provide both income (through rentals) and long-term appreciation. Real estate investment trusts (REITs) offer a way to invest in property markets without physically buying property.

Consider Your Risk Tolerance

At 65, you might be more risk-averse, which is perfectly understandable. Balancing risk and reward is crucial in maintaining financial security while trying to grow your investment. A financial advisor can help tailor a strategy that aligns with your risk tolerance and goals.

Don't Forget About Taxes

Investing strategically can also mean understanding the tax implications of your choices. Tax-efficient investment strategies can help you maximize returns. For instance, consider tax-free municipal bonds or looking into the benefits of a Roth IRA if eligible.

Conclusion: Planning for Peace of Mind

Investing a $100K inheritance wisely at 65 is not just about growing wealth but ensuring financial peace of mind. By assessing your situation, setting clear goals, diversifying your investments, and being mindful of your risk tolerance and tax implications, you can make informed decisions. How do you plan to invest your inheritance? Share your thoughts in the comments below!