Starting Your Dividend Journey: Insights for New Investors

Kickstart your dividend investing journey with these essential tips and insights.

Hey there, fellow budding investor! If you've ever thought to yourself, "How do I get started with dividend investing?", you're certainly not alone. Embarking on the journey of dividend investing can feel like sorting through a complex puzzle, but trust me, you're in the right place to piece it together.

What Are Dividends, Anyway?

Let's kick things off by demystifying the concept of dividends. Dividends are essentially a portion of a company's earnings that they share with investors. Think of it as your way of getting a slice of pie from a company's profits. Companies share their success with you as a thank you for your investment.

Why Consider Dividend Investing?

So, why bother with dividend stocks? The primary keyword here is "dividend income." These investments not only allow you to earn regular income but also offer the potential for growth over time. Imagine receiving a paycheck just for holding a piece of a company—sounds pretty sweet, right?

Stability and Predictability

Dividend stocks often come from established companies. These are businesses with strong track records, providing a sense of stability and predictability. For many, especially those approaching retirement, this stability is incredibly appealing.

The Basics of Building a Dividend Portfolio

Ready to dive in? Start by researching companies with a history of consistently paying and increasing dividends. You may also want to consider their dividend yield and payout ratio. Here are a few tips:

- Look for companies with a history of increasing dividends, often called "Dividend Aristocrats."

- Diversify your holdings across different sectors to manage risk.

- Consider the company's financial health and earnings growth potential.

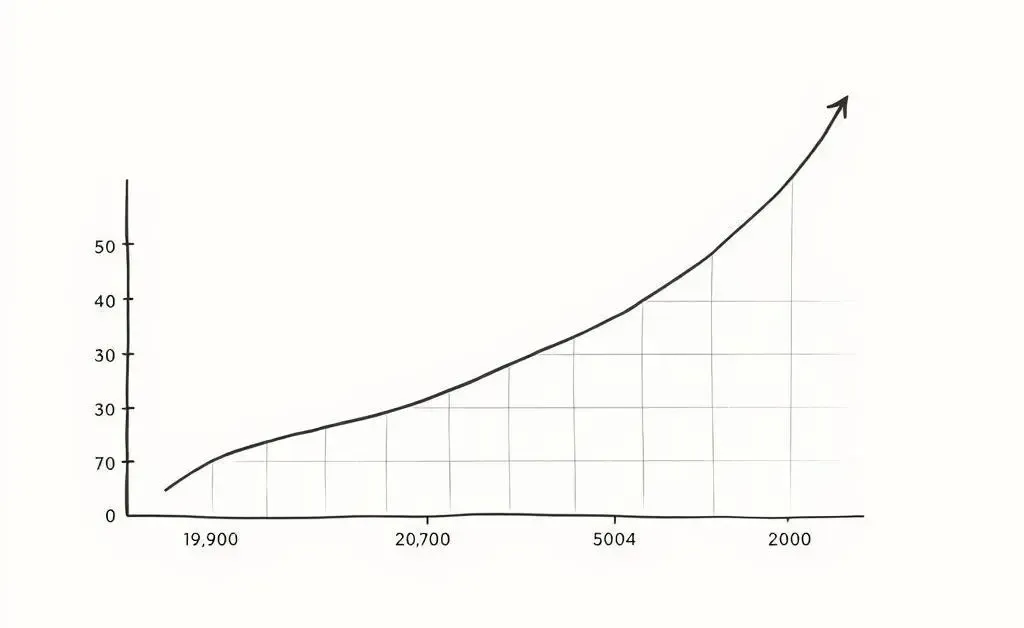

The Power of Reinvesting Dividends

One strategy that many seasoned investors use is reinvesting their dividends. By doing so, you're harnessing the power of compound growth. Each dividend reinvestment allows you to buy more shares, which can snowball into significantly bigger returns over the long term.

Risks and Considerations

As with any investment strategy, there are risks involved. While dividend stocks tend to be less volatile than growth stocks, they aren't immune to market downturns. Be prepared for both ups and downs in your investment journey.

Reflect and Plan Your Next Steps

Now that you've got a grasp on dividend investing, it might be a great time to reflect on what kind of investor you want to be. Are you in for the steady, long-term ride, or are you more interested in a mix of dividend and growth stocks? Either way, your next steps could involve setting up a brokerage account or researching companies that align with your financial goals.

Remember, investing is a journey, and there’s always more to learn along the way. What are your thoughts on starting your dividend adventure? I'd love to hear about what excites you the most!