Starting Your Financial Journey: Practical Tips for Beginners

Discover practical tips and relatable advice for navigating personal finance as a beginner.

Have you ever found yourself staring blankly at your bank statement, wondering where to even begin with personal finance? You're not alone. It can feel like navigating a foggy labyrinth, but worry not – once you get the hang of it, it's more straightforward than you might think. So let's embark together on this journey, equipped with practical tips for managing your money smartly and effectively.

Understanding Your Financial Starting Point

Think of your financial journey as planning a road trip. You wouldn't hit the road without knowing where you are and where you want to go, right? Begin with a clear picture of your current financial status. Take note of your income sources, monthly expenses, and any debts you might have. This initial step sets a solid foundation.

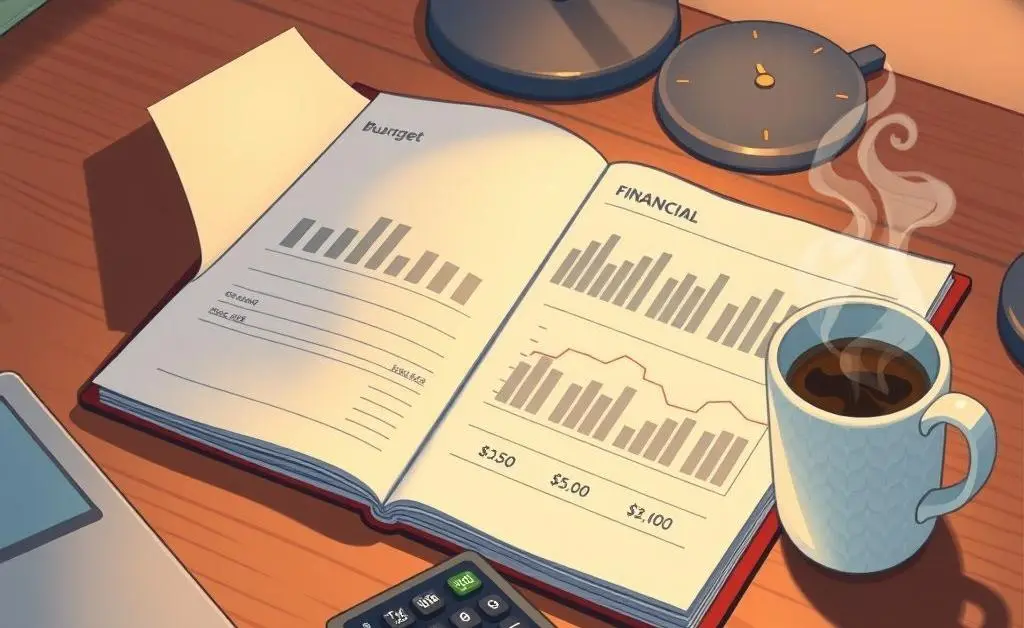

Creating a Budget: The Heart of Your Financial Plan

A good budget feels like a trusted map. It provides direction, helping you allocate funds efficiently without depriving yourself of life's little pleasures.

- List all your monthly income sources.

- Itemize necessary expenses: rent, utilities, groceries.

- Set aside a portion for savings.

- Consider discretionary spending with whatever is left.

Remember, budgeting is personal, so adjust these categories according to your needs. The goal is to create a balance that supports your lifestyle and long-term goals.

Savings: Building Your Cushion

Once you have a budget in place, the next logical step is to save. Imagine savings as the safety net catching you during life's unexpected moments – like a reassuring friend ready to support you.

Start with an emergency fund, aiming for three to six months of living expenses. It might sound daunting, but breaking it down into smaller, achievable goals makes it more manageable.

Investing: Growing Your Wealth

Why not let your money work for you? Investing is a powerful tool for creating wealth over time. While it might initially seem intimidating, the learning curve is part of the process.

Start with understanding the basics of stocks, bonds, and mutual funds. Consider speaking with a financial advisor for personalized guidance. Remember, consistency is key; even small, regular contributions can add up in the long run.

Keep Learning and Adapting

Financial literacy is an ongoing journey. Stay curious, keep learning, and don't be afraid to adapt as your life circumstances change. Whether reading a new book on investing strategies or attending a financial wellness workshop, stay engaged and proactive about your financial health.

And now, I'm curious: What aspect of personal finance are you most eager to explore next? Share your thoughts with me!