Strategies to Achieve Financial Freedom: Tips from the Debt-Free Community

Explore practical tips to achieve financial freedom from the debt-free community.

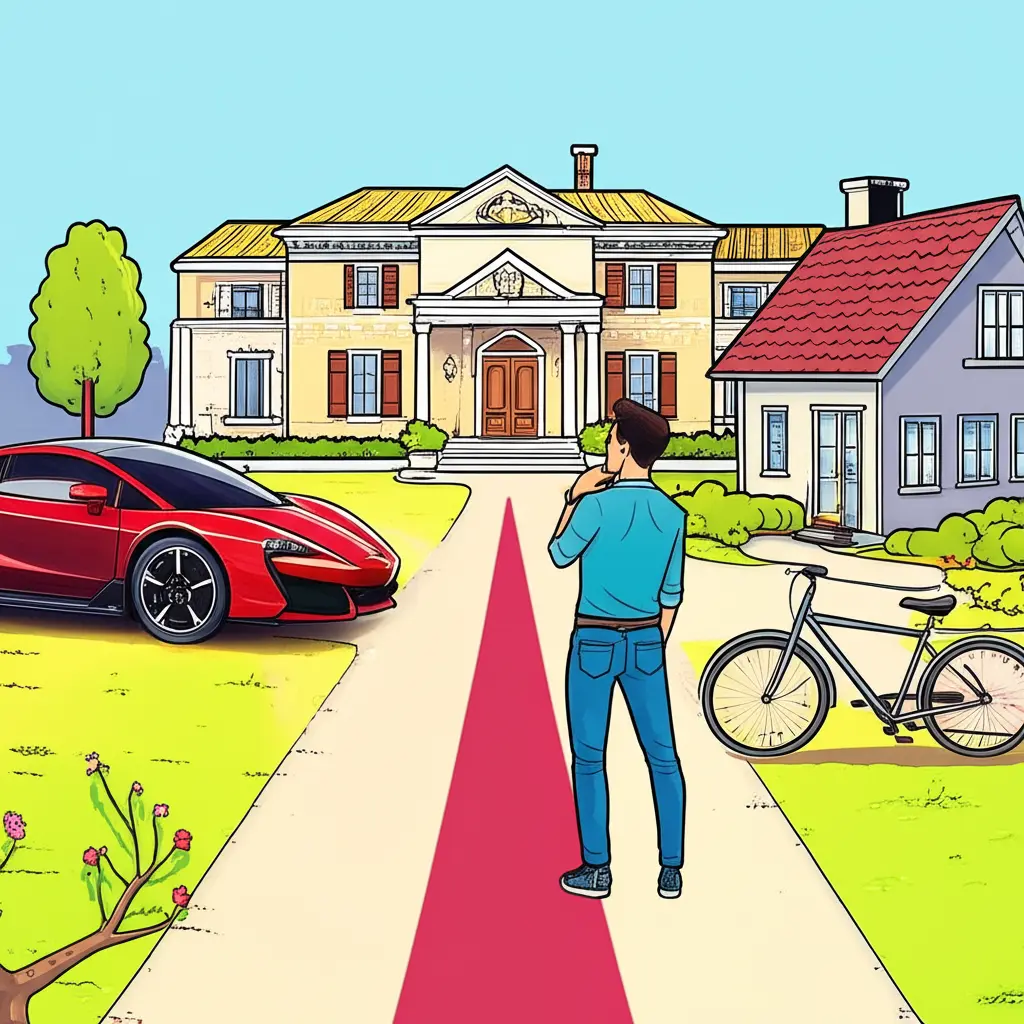

Have you ever wondered what it truly takes to achieve financial freedom? You’re not alone. Many people are seeking ways to escape the burden of debt and live a more financially secure life. Today, I’m sharing insights inspired by the collective wisdom of folks who've successfully navigated their journey to becoming debt-free.

Understanding the Importance of Setting Clear Financial Goals

The first step to financial freedom is setting clear, achievable goals. It's like setting a destination before starting a road trip. These goals can range from small, such as saving a set amount each month, to significant milestones like paying off a mortgage or student loans. Start by writing down your financial goals and breaking them into smaller, more manageable steps. This approach not only makes your journey seem less daunting but also keeps you motivated as you check off each milestone.

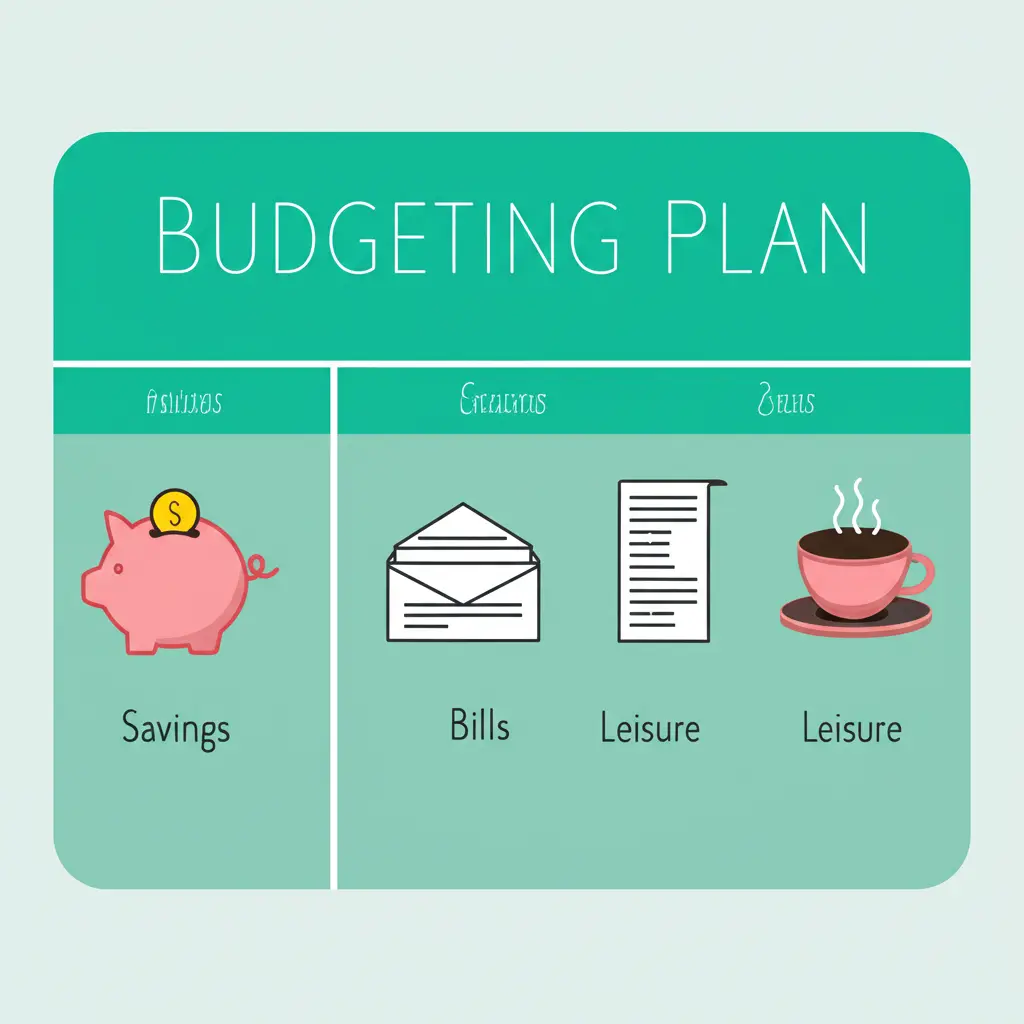

Embracing the Power of a Well-Planned Budget

Creating a budget doesn’t have to be a dreaded task. Think of it as a tool that gives you control over your finances. Prioritize essential expenses, allocate a portion of your income to savings, and then to discretionary spending. Remember the 50/30/20 rule? Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayments.

How to Stick to a Budget Without Feeling Restricted

You might be asking yourself, “How can I stick to a budget without compromising on fun?” The key is balance. It’s okay to indulge occasionally as long as it’s part of your planned expenses. Additionally, consider incorporating some frugal habits. Cook at home more often, seek free entertainment options, or buy second-hand items. These small changes add up over time, helping you stay on track financially.

Effective Strategies for Paying Off Debt

Debt management is crucial in achieving financial freedom. Start by listing all your debts and choosing a repayment strategy. Two popular methods are the snowball and avalanche methods.

- Snowball Method: Pay off debts from smallest to largest, gaining momentum as you eliminate each one.

- Avalanche Method: Focus on debts with the highest interest rates first, saving money in the long run.

Choose the method that best resonates with you and stay committed. The feeling of ticking off debt entries is incredibly satisfying!

The Psychological Shift Towards Financial Mindfulness

Last but not least, cultivate a mindset of financial mindfulness. This means being aware and intentional about your spending habits. Check in with your budget regularly, adjust as necessary, and reflect on what changes are working for you. Financial mindfulness helps you make conscious spending decisions, ultimately driving you closer to achieving financial independence.

As you embark on your journey toward financial freedom, remember that it takes time and patience. Celebrate your progress along the way. What’s one small step you can take today towards a debt-free life?