Surefire Tips for Beginners Interested in Dividend Investing

Unlock the basics of dividend investing with these approachable tips for beginners.

Have you ever fantasized about earning money while relaxing on a beach, sipping a refreshing drink? Perhaps you've heard the term 'dividend investing' tossed around in financial circles and wondered if that's the secret to that idyllic life?

What Is Dividend Investing?

Let's start at the beginning: Dividend investing is a strategy where you invest in stocks that pay you a portion of their earnings back. These payouts, known as dividends, can become a source of passive income over time. Sounds dreamy, right?

Why Start with Dividends?

The beauty of dividend investing is its simplicity and potential for steady income. For those new to finance, it offers a less volatile entry into the stock market compared to other options. You not only benefit from potential stock appreciation but also from the regular payouts.

How to Get Started

Let me share with you a story about Jim, my good friend who decided to dive into dividends. Jim was as green as they come to investing, but he figured he’d give it a whirl with just a few simple steps:

- Research and Choose Wisely: Jim started by researching stable companies with a history of consistent dividend payouts. This included sectors like utilities and consumer goods.

- Use Basic Tools: Armed with a trusty calculator and some basic charts, Jim tracked his dividends and reinvestments religiously.

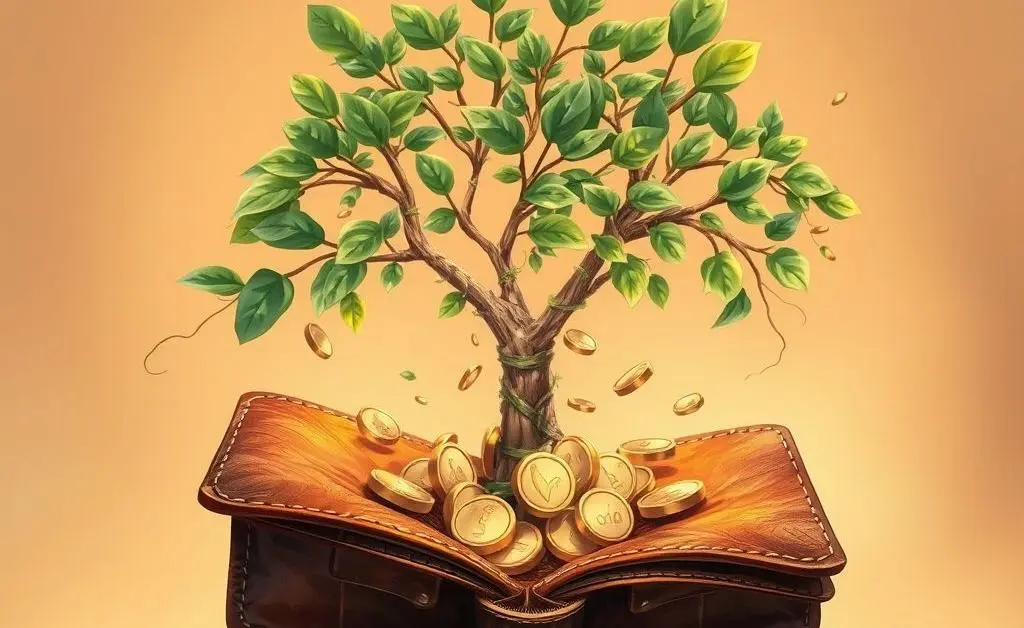

- Think Long-Term: Jim focused on the long haul, reinvesting his dividends to compound his earnings over time.

Common Pitfalls to Avoid

While Jim did well, it wasn’t without hiccups. Like many beginners, he initially aimed for the highest yields without considering company stability. Hindsight is 20/20, and he realized a sustainable yield often beats higher-risk, high returns in the long run.

The Ideal Dividend Portfolio

Building a diversified portfolio is key. Mixing strong blue-chip companies with a couple of high-growers can balance risk and growth. Be sure to thoroughly review financial statements and stay updated with market trends.

Are You Ready to Dive In?

Dividend investing can turn into a rewarding adventure with patience and wise choices. So, are you ready to plant the seeds for your dividend tree or perhaps nurture one that's already budding?