The Fidelity Cash Management Account: Your New Primary Checking?

Explore the benefits and considerations of using a Fidelity Cash Management Account as your primary checking solution.

I've recently found myself diving into the world of alternative banking options and stumbled across something intriguing: the Fidelity Cash Management Account (CMA). It led me to wonder, could this be the ultimate solution for simplifying my banking, or even replacing my primary checking account?

What is a Fidelity Cash Management Account?

Think of the Fidelity CMA as a blend of a brokerage account with the convenience of a checking account. It's designed to handle your everyday banking needs, but with some unique perks that can help you save money and even earn a little interest. The primary keyword here is Fidelity Cash Management Account.

Why Consider Fidelity's CMA for Your Primary Checking?

First off, let's talk fees. Or, the lack thereof. Fidelity boasts no account fees, no minimum balances, and offers reimbursement for ATM fees worldwide. For someone who's tired of hidden banking fees, this is a breath of fresh air.

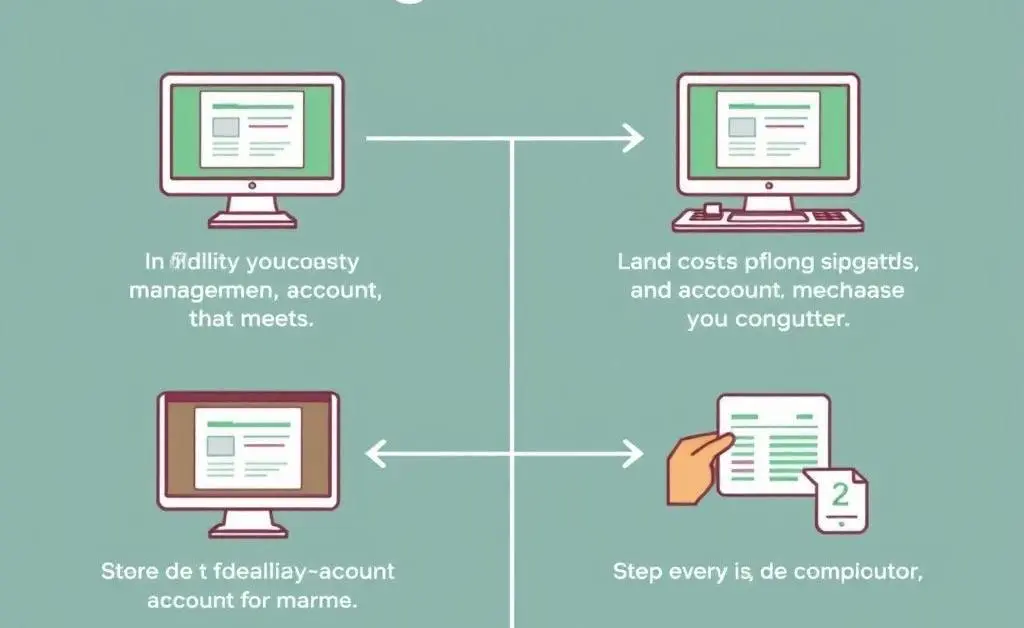

Security is another biggie. The CMA is FDIC-insured, which essentially means your money is safe, similar to a standard bank account. Plus, with Fidelity's robust online platform, managing funds is convenient and secure.

Perks of a Fidelity CMA

- No fees or minimums

- Worldwide ATM fee reimbursements

- High-interest savings potential

- Ease of management through an intuitive platform

Potential Drawbacks to Consider

While it sounds fantastic, there are things to watch out for. If you're someone who deposits cash frequently, note that the process isn't as straightforward as walking into your local bank branch. Also, since it's not a traditional bank, services like branch access and instant transactions with cash may be limited.

How to Get Started with Fidelity's CMA

If you’re convinced that this is the route for you, setting up is straightforward. Simply head to Fidelity’s website, create an account if you don’t already have one, and follow the guided steps to open your CMA. It’s user-friendly and takes just a few minutes to get rolling.

Final Thoughts: Is it Right for You?

Switching to a Fidelity Cash Management Account as your primary checking solution might just be the savvy move for your financial situation, especially if you're seeking to cut out fees and enjoy the flexibility of a modern banking experience. That said, remember to assess your personal banking needs and whether the trade-offs align with your financial habits.

Have you tried using a non-traditional banking solution for your primary checking? I'd love to hear your thoughts on how that’s working out for you!