personal finance

The Power of Consistency: Lessons from Pension Funds for Your Finances

Discover how pension fund strategies can inspire your personal savings plan.

A peaceful landscape symbolizing growth and financial stability.

Have you ever looked at pension funds and wondered how they manage to stand the test of time through economic ups and downs? Pension funds might seem like the domain of financial experts, but there’s a lot we can learn about personal finance just by observing how they operate.

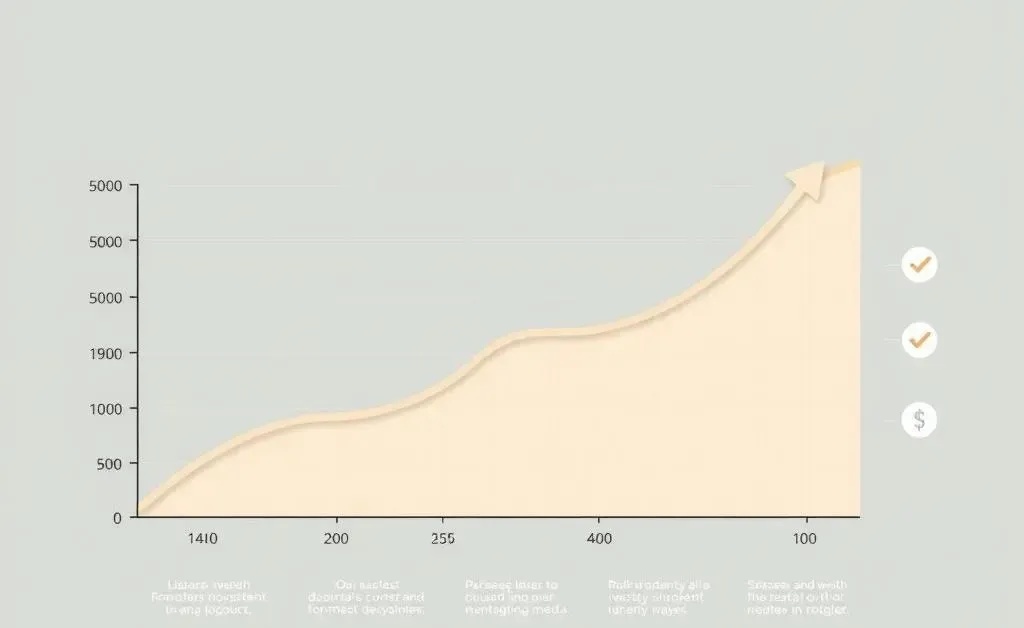

The Secret Sauce: Consistency Over Timing The secret to a successful pension fund isn't about making spectacular, one-time gains. Instead, it's the art of being consistent. This is a valuable lesson for our own

Pension funds are masters of diversification. They spread investments across different asset classes which cushions them against market volatility. Even if one segment underperforms, others might keep fund returns steady. Applied to personal finance, a diversified portfolio could involve a mix of stocks, bonds, and other investment types that match your risk tolerance. Remember, the idea is to avoid putting all your eggs in one basket.Setting Clear Goals: Planning for the FuturePension funds have a clear mandate: provide for retirees over the long term. This clarity is crucial; it guides their investment strategies and risk management practices. Similarly, setting clear financial goals can help guide your saving and investing tactics. Whether it’s buying a house, securing education funds for children, or planning for retirement, having specific goals can help you stay focused and motivated.Avoiding Emotional InvestingOne of the biggest advantages pension funds have is their discipline. Emotional decisions are often detrimental, especially in investing. By sticking to a well-laid-out strategy, you can weather the market's storms without panicking and making rash decisions, much like these funds.Final Thoughts: Emulating the ProsIf there's one takeaway from the way pension funds handle their investments, it’s the importance of playing the long game. With consistent contributions, diversification, clear goals, and controlled emotions, you can create a resilient personal financial plan. Remember, the journey to financial security is a marathon—not a sprint. How are you planning to incorporate these strategies into your own life?