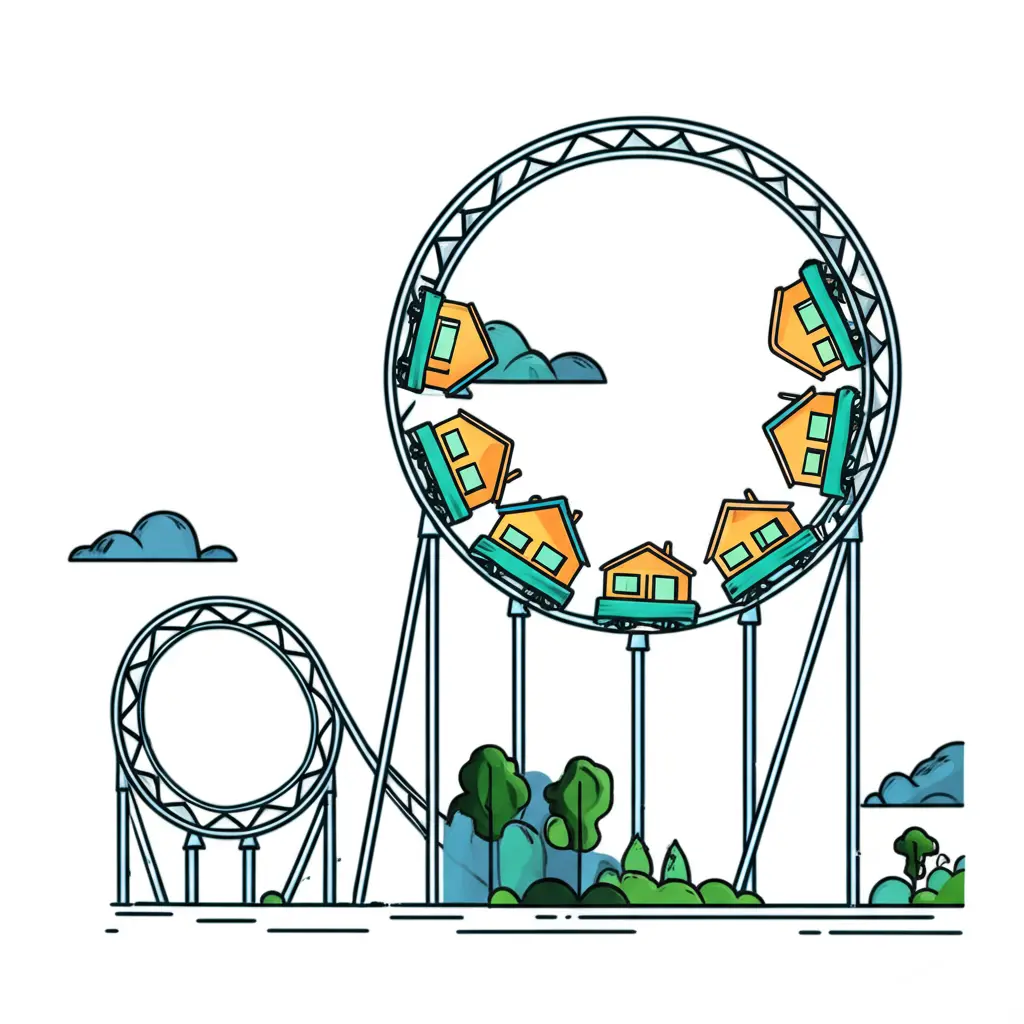

The Rollercoaster of Real Estate: Will the Market Ever Stabilize?

Explore the ebbs and flows of real estate investing and strategies for market stability.

If you’ve ever felt like investing in the real estate market is akin to riding a rollercoaster, you’re not alone. The thrill of the ride, the precipitous drops, and the cautious climb back to stability can be a wild experience, leaving many wondering: Will the real estate market ever stabilize? Let’s dive into this ongoing adventure and explore some strategies that might help smooth the ride.

Understanding the Ups and Downs

The real estate market is notorious for its fluctuations. Market cycles in real estate typically go through four phases: recovery, expansion, hyper supply, and recession. Each phase has its unique characteristics and effects on investment opportunities. The key to navigating these cycles is understanding where you are in the cycle and adjusting your strategy accordingly.

Identifying Market Signals

So, how do you identify which phase the market is currently in? Look for key indicators such as occupancy rates, housing starts, and interest rates. The National Association of Realtors provides valuable data on these metrics. When interest rates are low, the market is usually in an expansion phase, whereas high interest rates could indicate approaching recession.

Pros and Cons of Real Estate Investment

Let's face it, every investment comes with its own set of pros and cons. On the one hand, real estate can offer a tangible asset and the potential for passive income through rental properties. On the other hand, the initial investment and market risks can be substantial. Knowing which side of the fence you’re on helps investors like us make informed choices.

Risk Management Strategies

Mitigating risk is crucial for long-term success in real estate. Diversification is one effective strategy to consider. By investing in different types of properties or geographic locations, you can spread risk and increase the likelihood of stable returns. Additionally, maintaining a solid cash reserve can act as a buffer during market downturns.

What the Future Holds

The question remains, will the real estate market ever stabilize completely? Realistically, probably not, but that’s not necessarily a bad thing. With volatility comes opportunity. By staying informed and adaptable, investors can thrive despite—or even because of—the market’s inherent ups and downs.

Have you had experiences navigating the real estate market’s twists and turns? Share your thoughts below, and let’s continue the conversation about this dynamic investment landscape.