The Simple Path: Rolling Over Your 401(k) to an IRA

Discover the easy steps to roll over your 401(k) to an IRA in this comprehensive guide.

Why Consider a 401(k) to IRA Rollover?

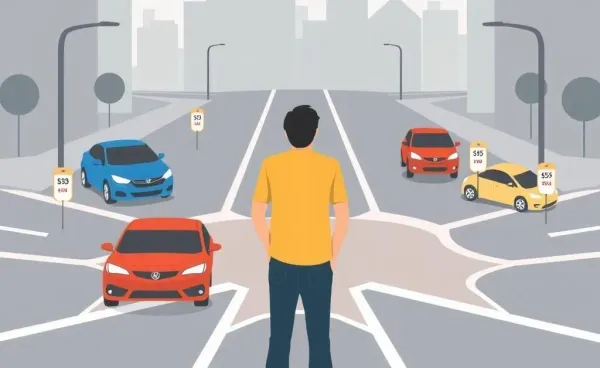

So you're thinking about rolling over your 401(k) into an IRA. But what does that actually mean, and why would someone choose to do it? Let's explore!

More Control and Flexibility

Rolling over your 401(k) to an IRA often gives you greater freedom over your investment choices. With an IRA, you typically have a wider range of investment options compared to most 401(k) plans. If you're someone who enjoys having lots of choices in crafting your financial future, this could be a great advantage.

Potential Lower Fees

Another consideration is fees. 401(k) plans sometimes come with administrative fees that IRAs may not have. By moving to an IRA, you could potentially save on these costs. It's like finding a better deal at your favorite store.

The Steps to Rollover from 401(k) to IRA

Let's break it down into a simple checklist:

- Research IRA Providers: Look for providers that match your needs in terms of investment options, fees, and services.

- Open an IRA Account: It’s usually a straightforward process, and many providers guide you step-by-step online.

- Contact Your 401(k) Provider: Request a rollover. They might ask you to fill out some forms—an opportunity to brush up on your penmanship!

- Direct vs. Indirect Rollover: In a direct rollover, funds go straight from your 401(k) to your IRA, which is usually the smoother route.

- Invest Your Funds: Once the transfer is complete, you'll decide how to invest the funds within your new IRA.

When Is the Best Time to Rollover?

Your timing can be key. Consider rolling over when you change jobs, retire, or when the market conditions feel right for you.

What’s Your Next Step?

Rolling over your 401(k) into an IRA can seem like a big decision, but with the right guidance, it can lead to a more tailored retirement plan that's just for you. Have you considered the benefits of financial advice, or even explored different providers for your IRA?