The Smart Investor's Approach to International Markets

Explore the benefits and risks of international investing for a balanced portfolio.

Have you ever wondered if investing in international markets is a good idea? Many investors find themselves pondering this question as they consider ways to diversify their portfolios and tap into global growth opportunities.

Why Consider International Markets?

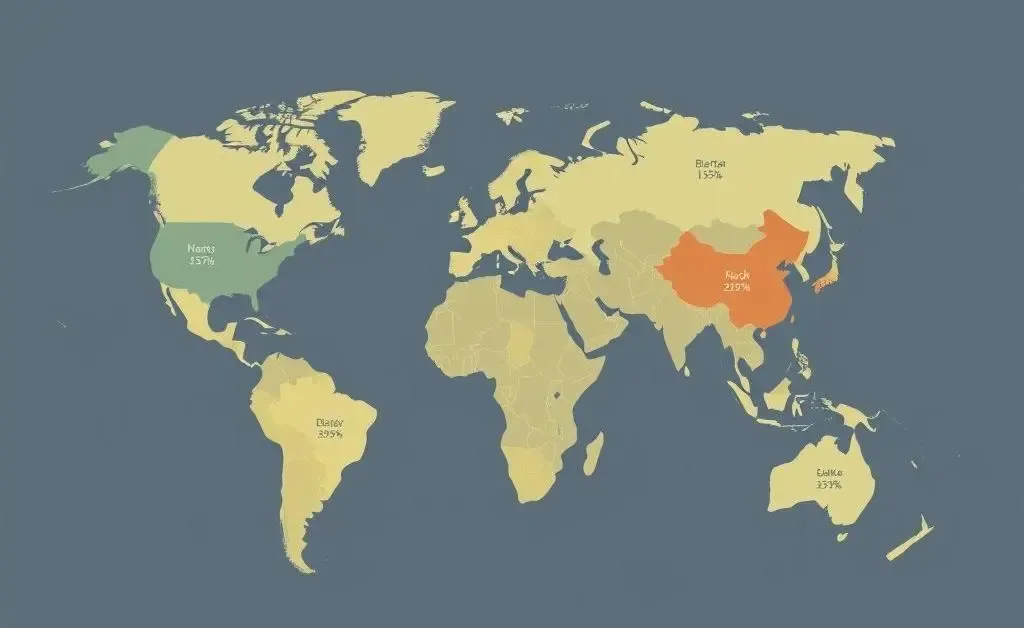

Investing in international markets can offer compelling benefits. First, it enhances diversification. When your assets are spread across different regions, you're less vulnerable to economic downturns in any one country. This can add a layer of robustness to your portfolio.

However, there's more to it. International markets can also offer varied growth opportunities beyond what domestic markets provide. Emerging markets, for example, often exhibit rapid growth due to burgeoning industries and increasing consumer demands.

- Growth potential: Access rapidly growing economies.

- Diversification: Spread out geopolitical risks.

- Currency exposure: Potential to hedge against your home currency’s decline.

Understanding the Risks

While there are advantages, it's essential to weigh them against potential risks. Currency fluctuations can affect your returns, as your investments might lose value if the local currency depreciates against your home currency. Moreover, geopolitical risks, such as political instability or regulatory changes, can impact international markets significantly.

A friend of mine once shared a story of how they invested in an international fund that seemed promising. Initially, the returns were stellar, riding on the wave of a strong currency. But when the policies in the country shifted, so did the fortunes of the investment. This anecdote vividly illustrates the importance of staying informed about international developments.

Finding the Right Balance

To benefit from investing internationally, it's crucial to maintain a balanced approach. Here are a few tips:

- Research thoroughly before investing and keep up with international news.

- Consider ETFs or mutual funds specializing in international investments for reduced risk.

- Monitor currency trends to anticipate potential impacts on investments.

- Consult with a financial advisor to tailor your international exposure to your personal risk tolerance.

Conclusion

Incorporating international markets into your investment strategy can be a game-changer if approached thoughtfully. What’s your take on international investing? Would you venture beyond your local markets to explore the unknown, or does the thought of added complexity make you cautious? Share your thoughts below or let's chat more in the comments!