The Surprising Power of Long-Term Investments: What a 28-Year Bond Taught Me

Discover the benefits of holding onto long-term investments and how they can reshape your financial future.

Let me start by sharing a little story: A few months back, I stumbled upon an old bond I’d completely forgotten about. It was a 28-year-old bond left to grow quietly in the financial shadows. When I finally cashed it in, the value had pleasantly surprised me. This little incident got me thinking about the nature of long-term investments and their often hidden power.

The Longevity of Investment

Many of us get caught up in the rush of daily expenses and the sometimes overwhelming complexity of managing our finances. But occasionally, there’s real magic in letting something sit and grow quietly over decades. My bond was a classic example, making me wonder why I’d never pondered over it sooner.

Why Consider Long-Term Investments?

So why should anyone look at investing in long-term bonds or other similar vehicles? Here are a few reasons that sprang to mind:

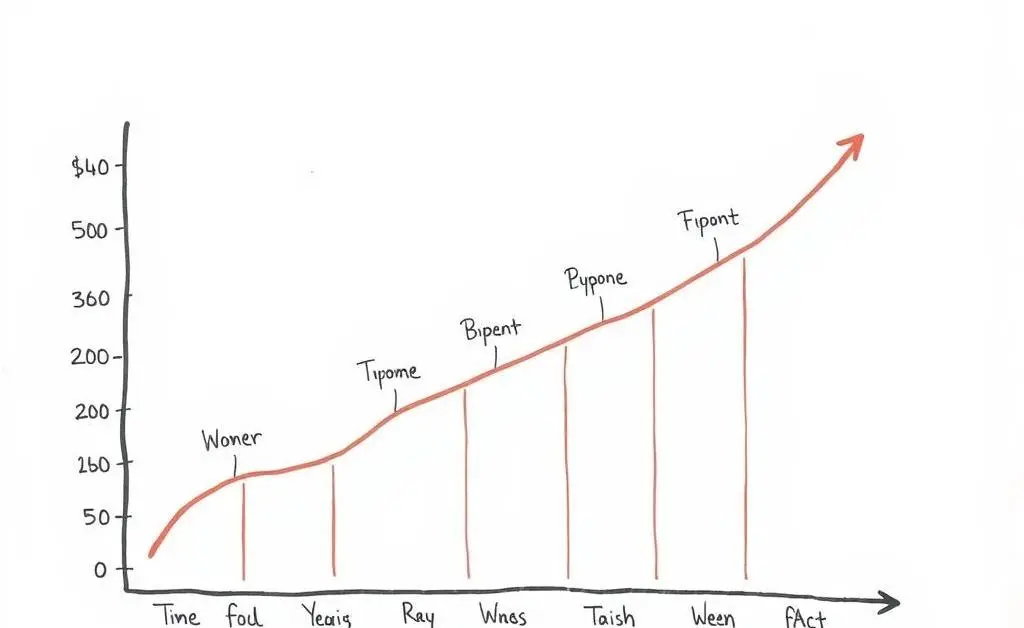

- Compound Interest: The most obvious reason is the magic of compounding. Even a modest return can turn substantial over a considerable period.

- Financial Milestones: Long-term investments can serve as a safety net for significant financial milestones, such as buying a home or paying for education. Imagine the peace of mind that brings!

- Less Stress, More Gain: Having money tucked away in a long-term bond or investment can often mean less stress in the short term. You’re not checking market fluctuations every day — instead, you're in it for the long haul.

How to Get Started

It’s not too late to start thinking long-term. Here’s what you can do:

- Evaluate Your Goals: What are your financial goals for the next 20 or 30 years?

- Consider Diversification: Look into different options, such as long-term bonds, stocks, or index funds, to see what aligns with your financial strategy.

- Consult a Financial Advisor: Sometimes, an expert can offer insights specific to your situation, making it easier to decide.

Conclusion: The Unexpected Joy of Patience

Cashing in that bond reminded me of the unexpected joys that patience can bring in financial journeys. Perhaps it’s time we all consider what small, forgotten seeds could grow into mighty oaks one day.

Have you ever stumbled upon a forgotten investment or planned your way to a delightful financial surprise? Share your stories or thoughts in the comments!