The Surprisingly Lucrative Logic of Long-Term Bonds

Learn how a long-term bond's hidden potential could transform your financial journey.

Have you ever stumbled upon an old financial document that turned out to be a hidden gem? Recently, a fascinating discovery in an old stack of papers offered a rewarding surprise after nearly three decades. Not only did it pique my curiosity, but it also got me pondering the unsung potential of long-term bonds — those sleeping giants of our finance cabinets.

Why Consider Long-Term Bonds?

For those new to the world of investments, a bond might just seem like a dusty piece of paper in your parents' or grandparents' file drawer. Here’s where it gets exciting: bonds, unlike stocks, provide a stable and predictable income stream. But what happens if you hold onto them for decades?

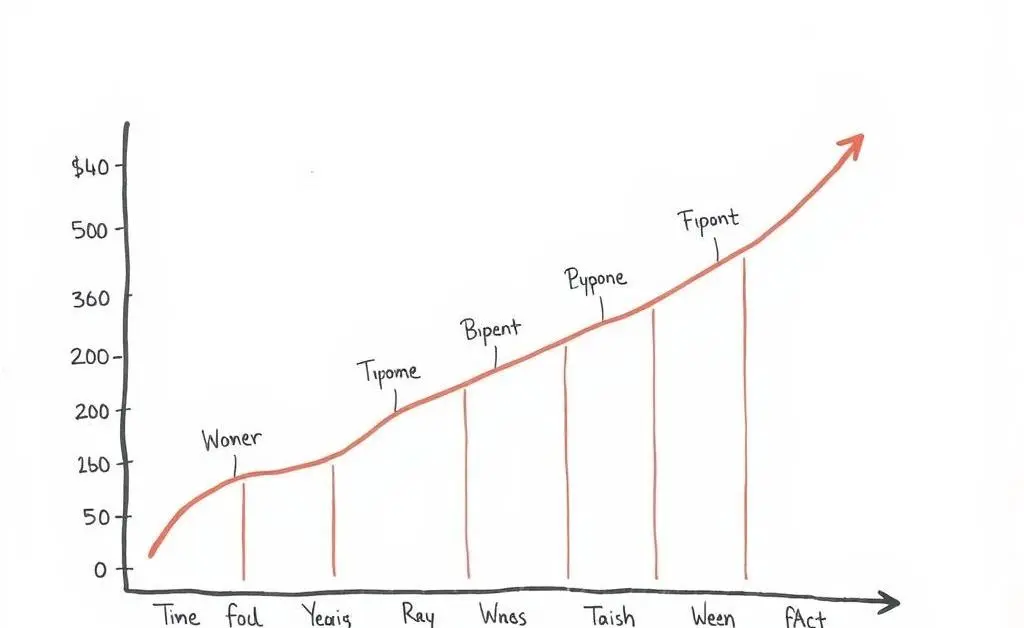

The Power of Patience

While patience is not always lauded in fast-paced financial arenas, long-term bonds reward the virtue of waiting. They offer the potential for significant growth due to compounding interest. This makes them an ideal choice for those who might be risk-averse or interested in a diversified savings approach.

Advantages of Long-Term Bonds

- Low Risk: Traditional bonds are typically safer than stocks.

- Predictability: Know what to expect with fixed interest rates.

- Deferred Tax Benefits: Pay taxes on interest when you cash in, not annually.

Minding the Downside

While bonds offer bright prospects, it’s essential to approach them with a well-rounded understanding. Inflation can erode the purchasing power of bond returns over time, and early redemption might cause it to lose potential interest gains. Thus, balancing your portfolio with various financial tools is key to managing risk effectively.

Keeping Realistic Expectations

If you’re considering purchasing a long-term bond, patience and long-term planning become indispensable. Learning more about bonds can build confidence in this continuing commitment.

Your Long-Term Strategy

Reflecting on your financial strategy and aligning it with personal goals can significantly improve your financial future. Whether you’re planning for a big purchase, retirement, or simply wish to grow your savings, considering long-term bonds as part of a diversified investment strategy might be the treasure you never knew you had.

Have you discovered unexpected value in any financial investments? Please share your stories or thoughts below!