Understanding Appraisal vs. Listing Price Differences

Navigate the real estate world by understanding appraisal and MLS listing discrepancies in simple terms.

Welcome to the thrilling world of real estate! If you're venturing into buying or selling a home, you've likely encountered the terms appraisal and MLS listing. Today, we're going to demystify why appraisal and listing prices sometimes don't see eye to eye, much like a cat and a vacuum cleaner.

What's an Appraisal Anyway?

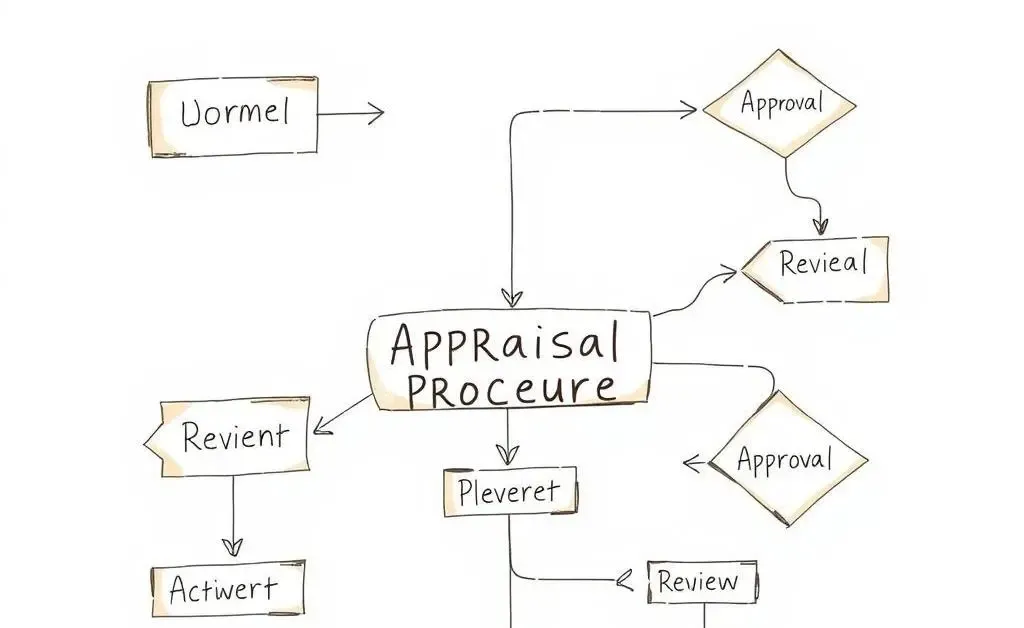

An appraisal is essentially an expert's estimate of a property’s current market value. This is determined by an impartial third party, and factors like the condition of the property, recent sales in the area, and sometimes, the mood of the appraiser on that particular day (we kid, sort of) are all taken into account.

What's Up with MLS Listings?

On the flip side, the MLS listing price is what the seller hopes to fetch. It's part wishful thinking, part market analysis, and entirely a starting point for negotiations. This price is set by the seller, often with advice from their real estate agent, and considers desired profit as well as market trends.

Why the Discrepancy?

The gap between the appraisal and listing price can be attributed to several reasons:

- Market dynamics: In a hot market, sellers might list higher, banking on demand surpassing supply.

- Emotional value: Sellers may overvalue sentimental aspects that don't add actual market value.

- Strategy: Listing high can sometimes work as a negotiating tactic or to start a bidding war.

How Should You Navigate This?

If you're buying, and the appraisal comes in lower than the asking price, it's sometimes a blessing in disguise. Here's what you can do:

- Negotiate: Use the appraisal as leverage to bring the price down.

- Walk away: If the numbers don’t work out, it might be wise to keep looking.

- Re-appraise: Sometimes, mistakes happen. Getting a second opinion could be beneficial.

For sellers, ensuring you understand the gap can prevent a stalled deal. Keep appraisals in mind when setting your price, or be prepared to justify your listing to potential buyers.

Your Real Estate Finale

Buying or selling a home is a significant emotional and financial journey. Understanding the nuances between appraisal and listing prices can make this adventure less daunting. Have you ever faced discrepancies in home prices? How did you handle it? Let’s hear your stories or questions in the comments below.