Understanding Auto Insurance After Your First Accident

Navigating auto insurance after your first accident made simple.

Have you ever found yourself staring at a jumble of auto insurance terms after your first accident, wondering what to do next? You're not alone. It can feel like trying to decode a foreign language, but don't worry—together, we'll navigate these waters.

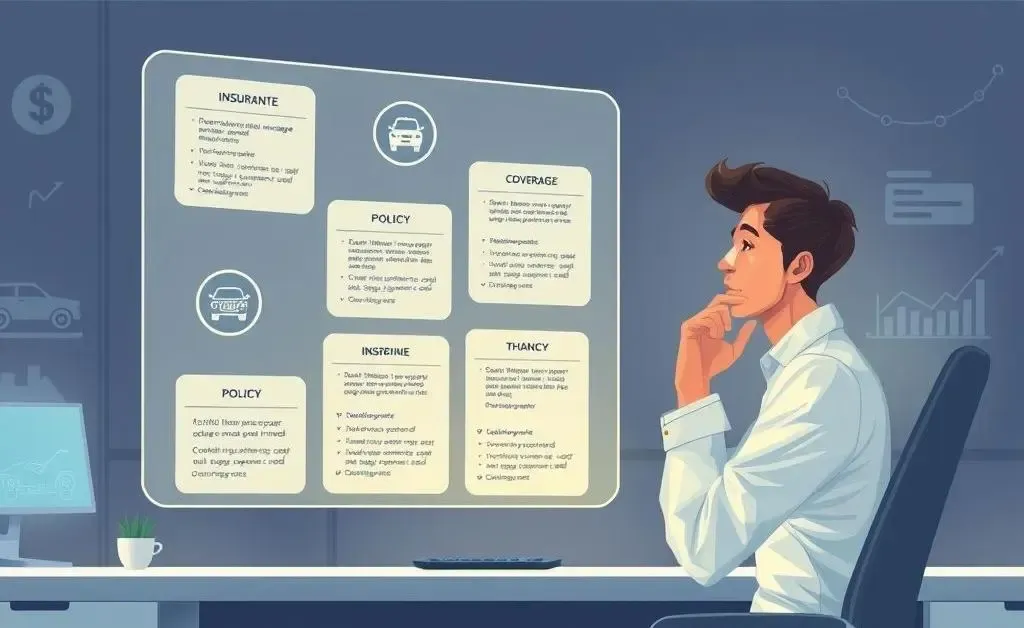

Deciphering Your Auto Insurance Policy

Understanding the ins and outs of your policy is crucial. Let's break down what matters when you experience your first auto accident:

- Liability Coverage: This helps pay for damages or injuries to others if you're at fault.

- Collision Coverage: This covers repairs to your car post-accident.

- Comprehensive Coverage: This takes care of damages not related to collisions, like theft or natural disasters.

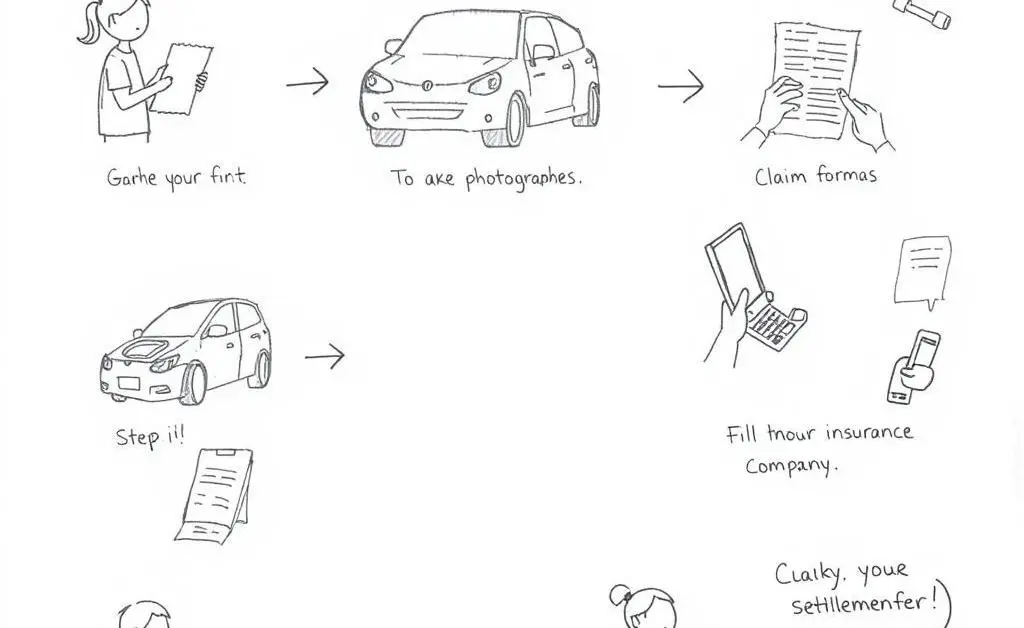

Filing an Insurance Claim: A Step-by-Step Guide

Filing a claim might seem daunting, but it's straightforward with the right approach. Consider this short anecdote:

After my friend Sarah had her first fender bender, she found herself unsure about the claims process. Taking a deep breath, she followed these simple steps:

- Document the accident—photos, dates, and witness details.

- Contact your insurance company without delay.

- Provide a clear account of the incident when asked.

- Review any paperwork sent your way.

- Stay in the loop regarding the claim's progress.

Sarah's story shows that with a bit of organization, you can ease through the claim process.

Choosing the Right Auto Coverage

When assessing your coverage options post-accident, consider what's best for your situation. Here are some tips:

Deductible vs. Premium: A higher deductible typically means a lower premium, but ensure you can cover that amount if needed.

Assess Your Needs: Evaluate your driving habits and the value of your vehicle to determine necessary coverage.

Insurance discussions can feel overwhelming, like diving into a never-ending pool of facts and choices. But with a little patience and curiosity, you'd be amazed how these concepts start to make sense!

Reflect and Adapt

Auto insurance might seem like an intricate puzzle at first, but with each piece you put in place, the picture becomes clearer. How can your experience help you make smarter choices for the future? Share your thoughts below!