Understanding Bank Check Deposits: What Happens Next?

Explore the process and common concerns around depositing checks into your bank account.

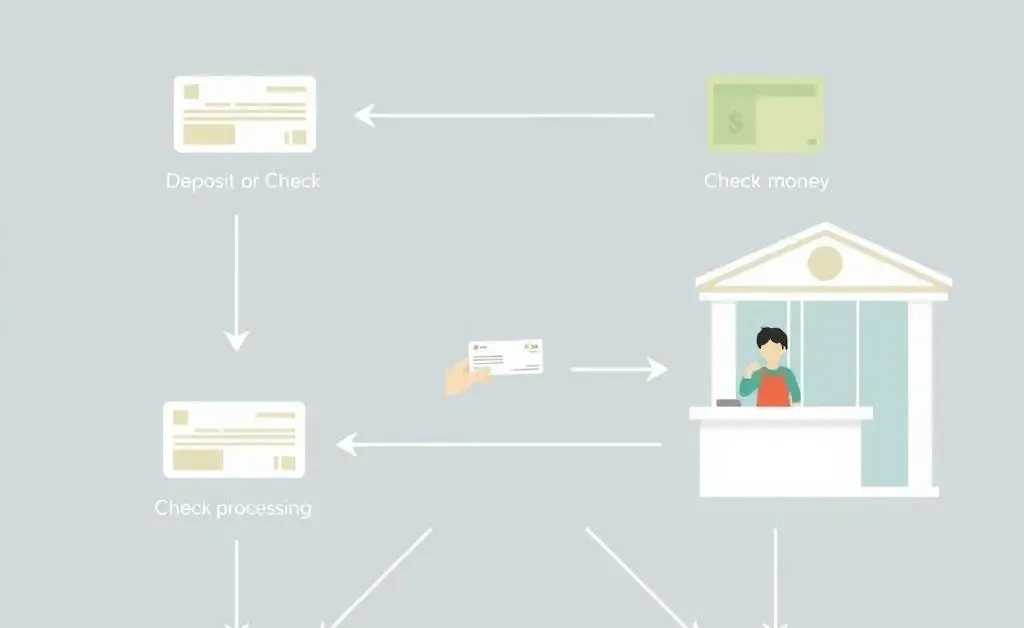

There's something about depositing a check that can feel a bit like magic, isn't there? You hand over a piece of paper, and some time later, money appears in your account. But what really happens behind the scenes after you drop that check at your bank? Let's delve into the world of bank check deposits and clarify a few common questions that often come up.

How Long Will It Take for My Check to Clear?

One of the most frequent concerns is how long you'll need to wait for funds to be available in your account. While it would be lovely if checks cleared instantaneously, there's typically a holding period. This timeframe can depend on your bank's policy, the check amount, and even the account's history.

Generally, funds from certain checks are made available within one or two business days. But a large check might require a longer holding period for clearance, so it's worth checking with your bank for specific details.

Why Does the Bank Hold My Money?

Banks place a hold partly for security reasons and to ensure the check is legitimate. Holding periods help protect banks from potential fraud and discrepancies. It's not about mistrusting you; it's a routine safety measure.

However, if you're in a pinch and need the money quicker, consider speaking to your bank. Sometimes, especially if you have a history of deposits without issues, they might release a portion of the funds sooner.

Steps to Take if Your Check is Misplaced

On rare occasions, checks can get lost in transit to clearing centers. If you're starting to wonder where your deposit went after a reasonable time frame, chat with a representative at your bank. Often, they'll have tracking mechanisms to locate your deposit or advise on the next steps.

Remember, while the bank manages a lot of the check-clearing process, you're not without resources or recourse if something seems off.

The Perks of Modern Banking Technology

With mobile check deposit, things are getting easier and quicker. This nifty technology allows you to deposit checks without needing to visit the bank physically, saving you both time and effort. Using mobile banking can also offer quicker access to your funds, as the electronic process often reduces hold times.

Nurturing a Good Relationship with Your Bank

Ultimately, maintaining a respectful and friendly relationship with your bank can be beneficial. Regularly reaching out for clarification or advice not only demystifies banking processes but also places you in a good position if ever you need exceptions or assistance.

Whether it's your first time needing to deposit a sizable check or if you're an old hand at managing funds, understanding your bank's processes equips you with confidence and patience. So, next time you find yourself waiting for a check to clear, know there's a method to the madness and plenty of support if you need it. Ever had a memorable experience depositing a check? Or tips on how to navigate the nuances of banking life? Feel free to share your thoughts and stories.