Understanding Credit Card Applications: A Beginner's Guide

Navigate credit card applications with confidence. Learn how to choose, apply, and maximize benefits.

Hey there! Diving into the world of credit cards can feel like you've stepped into a new territory where jargon reigns supreme. Fear not—I'm here to help you navigate the maze of credit card applications with confidence. Let's break it down so you can make informed decisions that work for your wallet and lifestyle.

How to Choose the Right Credit Card

Choosing a credit card that's right for you is like shopping for shoes—you want something that fits your needs, not just what's trendy. Here are a few things to consider:

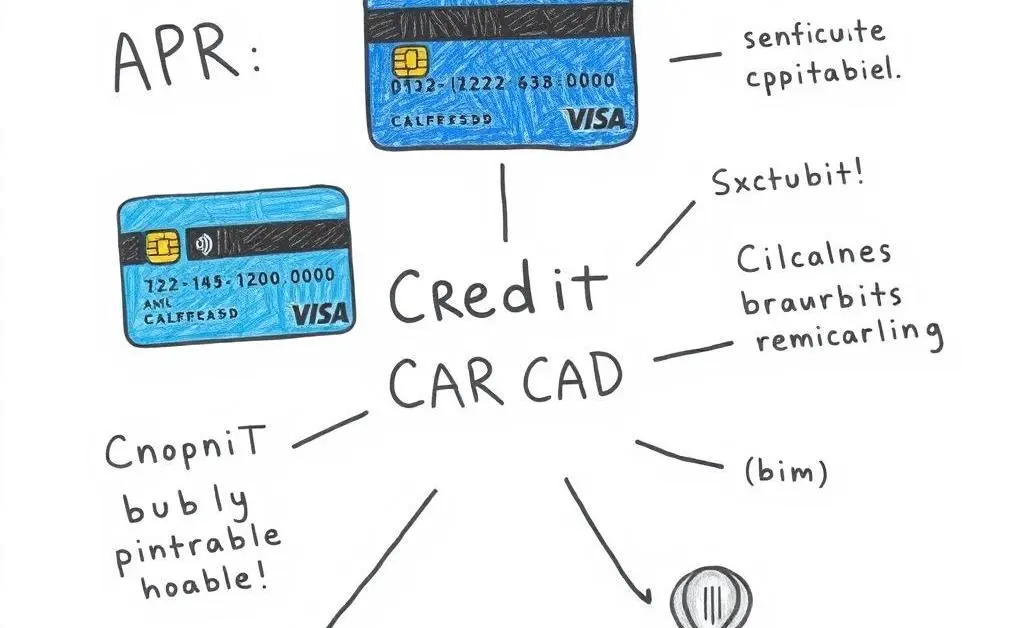

- Interest Rates: Check the annual percentage rate (APR). A lower APR is ideal, especially if you plan on carrying a balance.

- Rewards: Look for cards that offer cash back, travel points, or discounts in places you frequently shop.

- Annual Fees: Weigh the benefits of the card against any fees it might have. Sometimes, a fee might be worth the rewards you get.

- Introductory Offers: Many cards offer 0% APR for the first year or bonus points if you spend a certain amount within the first few months.

Preparing Your Credit Card Application

Once you've zeroed in on a credit card, it’s time to apply. Here's what you'll need:

- Personal Information: Have your basic details ready, like your Social Security number and address.

- Income Details: Credit card issuers want to ensure you have the means to pay back what you borrow. Be prepared to provide your income information.

- Credit History: A good credit score can make a big difference in qualifying for a card with better perks.

My advice? Double-check your credit report before applying, so there are no surprises. You can get a free report from the major credit bureaus annually.

Making the Most of Your Credit Card

Once you've secured a card, the key is maximizing its benefits:

- Pay Your Balance in Full: Avoid interest charges by paying off your balance each month.

- Use Rewards Wisely: Don't change your spending habits just to earn points, but use them strategically for things you need or love.

- Keep an Eye on Offers: Credit card companies often have limited-time offers that can enhance your rewards.

All right, my savvy financial friend, now you’re equipped with the basics of credit card applications. What questions do you have, or what’s stopping you from getting your first or next credit card? Let’s chat in the comments!