Understanding Diminished Value Claims: Your Comprehensive Guide

Learn all about diminished value claims in this comprehensive yet easy-to-understand guide.

Have you ever gotten into a car accident where you thought, ‘This doesn’t look too bad,’ only to find out that your car’s value has taken a bigger hit than expected? Understanding diminished value is crucial if you find yourself in such a situation.

What is Diminished Value?

The term 'diminished value,’ often wrapped in insurance jargon, simply refers to the loss in your vehicle’s market value after an accident, even once it’s repaired. This concept is significant because it can affect the money you ultimately receive if you're looking to resell or trade-in your car post-repair.

Why Does Diminished Value Matter?

Imagine trying to sell a car. Buyers usually shy away from vehicles that have been in accidents, and even perfect repairs can't eliminate the car's history. This reality is what gives rise to diminished value claims, allowing you to recoup some of your car’s lost value.

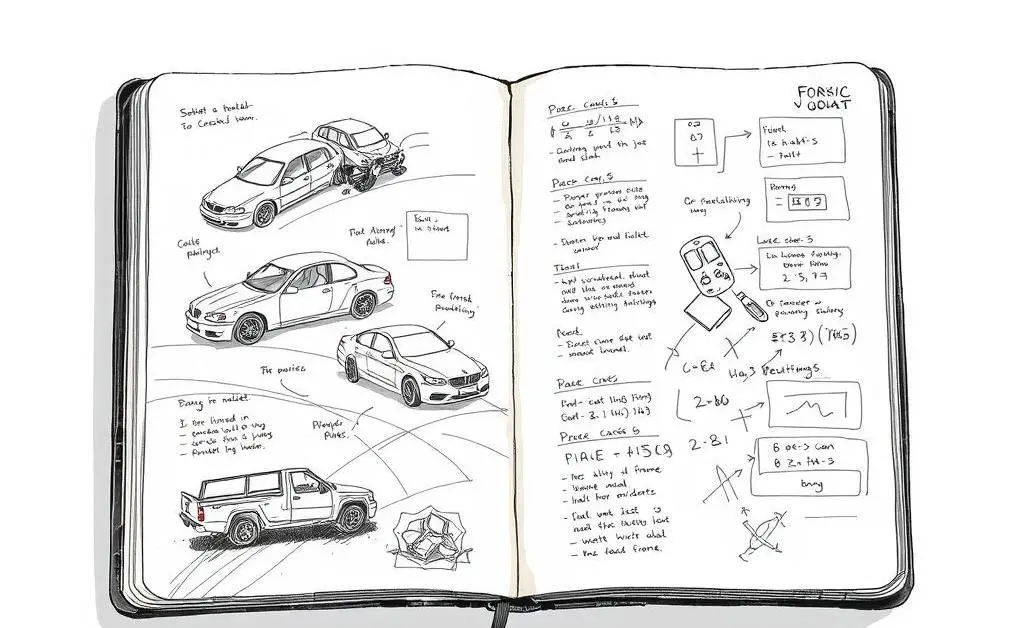

How to File a Diminished Value Claim

This process can feel daunting, but it's nothing you can't handle with a bit of guidance! Here’s a simplified checklist:

- Your car must have been damaged in a non-fault accident.

- A pre-existing car value must be established.

- An appraisal documenting your car’s post-repair value is essential.

- You'll need to present this evidence when filing the claim with your insurance company.

Let’s throw a little fiction in to make this clearer. Meet Alex, who was rear-ended while driving home. With a decreased car value after repairs, Alex felt puzzled about how this impacted resale. Through diligent research and working with an appraiser, Alex successfully recouped some of the car's original value with a diminished claim. Moral of the story? A bit of homework can save you money!

Key Takeaways of Managing Diminished Value

To get the most out of your car’s value post-accident, familiarize yourself with your state’s rules regarding such claims. Some states have unique protocols, so it's worth digging into them.

Finally, keep all documentation handy. You’ll be in a far better position to make your case if you stay organized.

Have you ever dealt with a diminished value claim? What was your experience like, and did you have any unexpected challenges? Feel free to share your story in the comments.