Understanding Diminished Value: What Every Car Owner Should Know

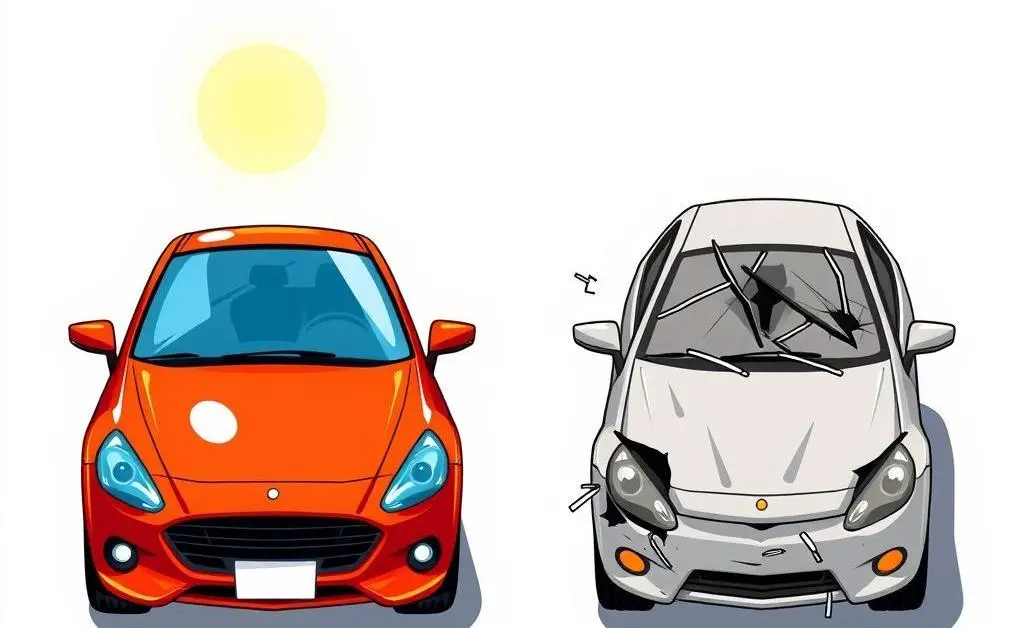

Explore how diminished value impacts your car's worth after an accident.

Have You Ever Wondered About Your Car's Diminished Value?

If you've ever been in a car accident, you might have heard the term "diminished value." But what does it actually mean for you and your vehicle? Understanding this concept can help you navigate insurance claims and keep your car's resale value intact.

What is Diminished Value?

Diminished value refers to the reduction in your car's market value after it has been involved in an accident and repaired. Even if your vehicle looks as good as new, its worth in the eyes of potential buyers might have taken a hit.

Simply put, a car that's been in a wreck, even after significant fixes, won't sell for as much as an identical car that has never been in an accident.

- Repair-related diminished value: Occurs if the repairs were not done properly.

- Immediate diminished value: The difference in resale value right after an accident.

- Inherent diminished value: The loss of value that remains after the vehicle is fully repaired.

My Personal Encounter with Diminished Value

Last year, I found myself in the very situation we're discussing. My car, a trusted companion for over five years, was rear-ended at a traffic light. The repair shop did a great job piecing it back together, but when I decided to sell it, buyers weren't willing to match its pre-accident value. I learned firsthand how diminished value affects you when looking to recoup costs.

How Diminished Value Impacts Your Insurance Claims

Insurance companies often have their own methods for calculating diminished value, and they're usually not what you might expect. It's crucial to read through your policy and ask the right questions to ensure you're getting a fair deal.

You might need to:

- Get a professional appraisal.

- Document all pre-accident conditions.

- Negotiate with the insurance adjuster.

What Can You Do About It?

Now, let's talk about what you can do. Advocating for yourself is essential. Gathering documentation of your car's previous condition, understanding your policy thoroughly, and sometimes even hiring a professional appraiser can make a big difference.

Have you experienced a similar situation? How did you handle it, and what tips would you share with others facing the same challenges?