Understanding Distribution vs Accumulation ETFs: What You Need to Know

Explore the differences between distribution and accumulation ETFs for better investing.

Hey there! Let’s dive into a topic that might seem a bit confusing at first but is incredibly helpful for those of us interested in growing our investments wisely: Distribution vs Accumulation ETFs. If you've been curious about how these two compare and whether they're really different at all, you're in good company. In this post, I'll break it down for you, highlight what you should consider, and hopefully make it all feel a bit more approachable.

What's the Difference Between Distribution and Accumulation ETFs?

The first time I encountered the terms 'distribution' and 'accumulation' in the context of ETFs, I felt a little lost. Let’s simplify it: A Distribution ETF pays out dividends or income directly to you. What you typically see is a cash payment at regular intervals. On the other hand, an Accumulation ETF reinvests these dividends back into the fund, which can often lead to a compounding effect.

Deciding Which ETF is Right for You

Choosing the right type of ETF depends on your financial goals and personal preferences. Here’s a handy checklist:

- Cash Flow Requirement: If you're relying on income from your investments, distribution ETFs might suit you as they provide regular payouts.

- Long-term Growth Focus: Accumulation ETFs reinvest the income, potentially giving you higher growth over time.

- Tax Considerations: Depending on where you live, distribution payouts can have different tax implications compared to reinvestment.

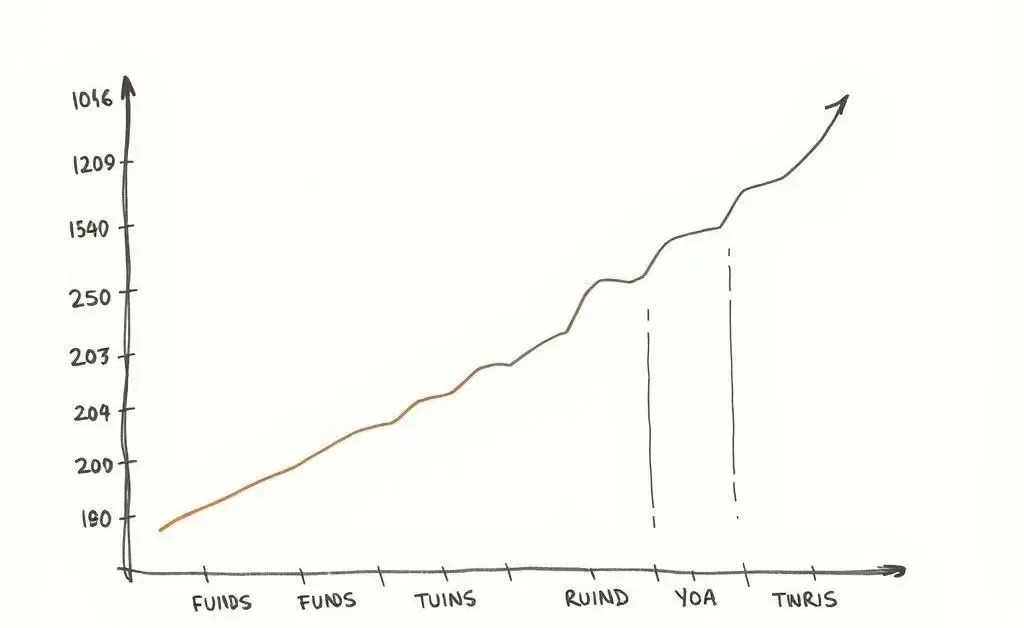

The Impact of Different Strategies

I remember a friend telling me about an eye-opening moment they had when they realized that despite choosing an accumulation ETF, their total returns mirrored those of someone with a distribution ETF. The key? While the payout strategies differ, both ETF types track the same underlying indexes. Here's why that might be:

- Both ETFs aim to mirror the same market performance, leading to similar overall returns.

- The difference lies in the path they take—in terms of cash payments versus compounding.

Navigating Choices: What’s Your Next Step?

If you're like me, a good cup of coffee and a chat about finances can be quite soothing. Take your time to consider what aligns with your current life stage and financial aspirations. Whether you choose distribution or accumulation, let it be a choice that supports your financial well-being.

In the end, understanding the nuances of distribution versus accumulation ETFs is about more than financial acumen—it's about empowering yourself to make informed decisions that nurture your future. Feel free to share your thoughts or questions with me. I’d love to hear what you’re contemplating.