Understanding ETF Overlap: Why Less Can Be More in Your Investment Portfolio

Curious about ETF overlap? Discover how it affects your investments and why simplicity could boost your gains.

Hey there! If you're anything like me, you've probably looked into ETFs as a way to diversify your investments without all the hassle of picking individual stocks. I mean, who doesn't love the idea of spreading risk and potentially raising returns? But here's a little wrinkle that not everyone talks about: ETF overlap.

What is ETF Overlap?

Picture this: You're buying into two different ETFs, thinking you're diversifying your portfolio. However, if both of these ETFs hold a significant number of the same assets, you're not really achieving the diversification you intended. It’s like ordering two dishes that taste almost the same — you’re not getting the variety you signed up for.

Why It Matters

So why should you care? Well, an overlapping ETF might dilute the benefits of diversification. Imagine you have two ETFs, each heavily weighted in tech stocks. If the tech sector hits a rough patch, both ETFs would be affected similarly, amplifying your losses rather than protecting against them.

How to Identify Overlap

The good news is, it’s pretty straightforward to spot overlap. Most fund providers offer detailed breakdowns of ETF holdings. If you notice your ETFs sharing a significant number of assets or sectors, there’s a good chance you’re overlapping.

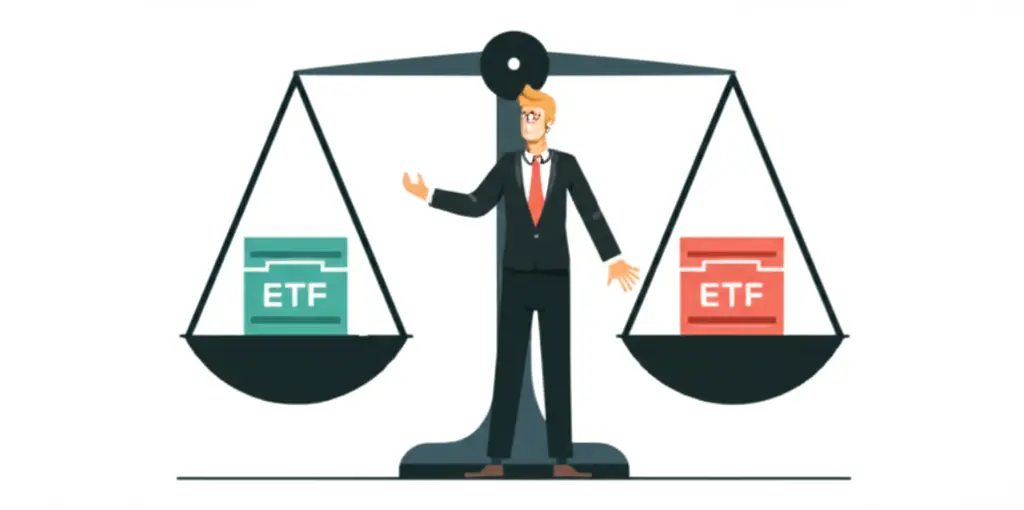

Minimizing Overlap

Okay, so we know overlap happens, how do we avoid it? Start by diversifying across different sectors and asset classes. For example, if you’ve already got a domestic equity ETF, you might want to look into an international or fixed-income ETF to balance things out.

Another strategy is to focus on thematic ETFs, which might target specific sectors like clean energy or technology, and mix them with broader market ETFs to keep things interesting and balanced.

Conclusion

In a nutshell, being mindful of ETF overlap can not only make your portfolio more robust, it's also a step towards smarter investing. So the next time you're eyeing those appealing ETFs, take a moment to check how much they share with what you already own.

Now, I’d love to hear from you. Have you encountered ETF overlap in your investment journey? Drop your insights or strategies in the comments below!