Understanding Financial Transparency: Unpacking the Role of Banks

Explore how banks manage transparency and its impact on financial trust.

Exploring Financial Transparency in Banking

Have you ever wondered what happens behind the scenes at your bank? Financial transparency has become a hot topic, especially as it relates to banks and how they handle money. Let's dive into how transparency helps build trust and why it's increasingly significant in today's world.

Why is Financial Transparency So Important?

Financial transparency is crucial for trust-building, particularly between banks and their customers. When a bank openly shares information about its operations, fees, and audits, it conveys reliability.

- Openness can prevent miscommunications.

- Transparency reduces fraud risks.

- It helps maintain a positive customer-bank relationship.

Imagine this: After weeks of researching financial institutions, you chose a bank that openly communicated its policies and fees. This transparency made you feel secure, knowing where your money goes and how it's handled. That's the kind of trust built by clear communication.

How Banks Can Improve Transparency

There are several ways banks can enhance transparency:

- Regular Audits: Conduct frequent audits and share outcomes with customers.

- Simplified Terms and Conditions: Use plain language to explain policies.

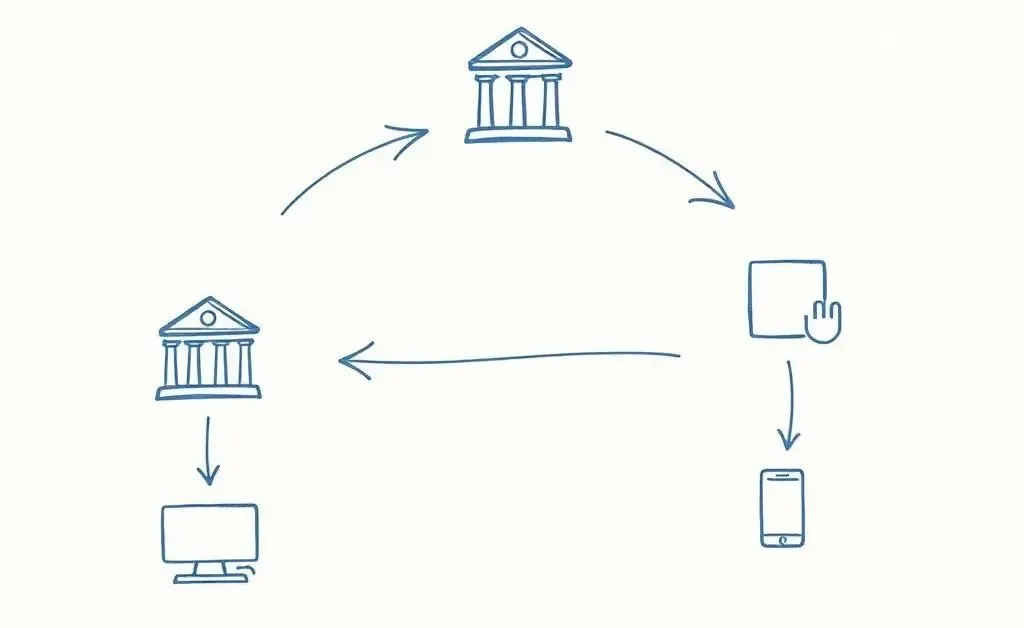

- Technology Utilization: Implement user-friendly online platforms showing real-time transactions.

The Impact of Transparent Banking

When banks operate transparently, they empower customers with knowledge about their finances and financial systems. This empowerment drives informed decision-making.

Challenges Faced by Banks in Transparency

Despite its importance, maintaining transparency isn't always straightforward. Banks face challenges like regulatory requirements, protecting sensitive data, and the cost of implementing transparent systems.

Final Thoughts

Financial transparency plays a key role in shaping the trust landscape between banks and their customers. As we gain more insights into the significance of openness, it becomes vital for banks to align with these values, ensuring mutual trust and a sense of security. What change would you like to see in how your bank handles transparency?