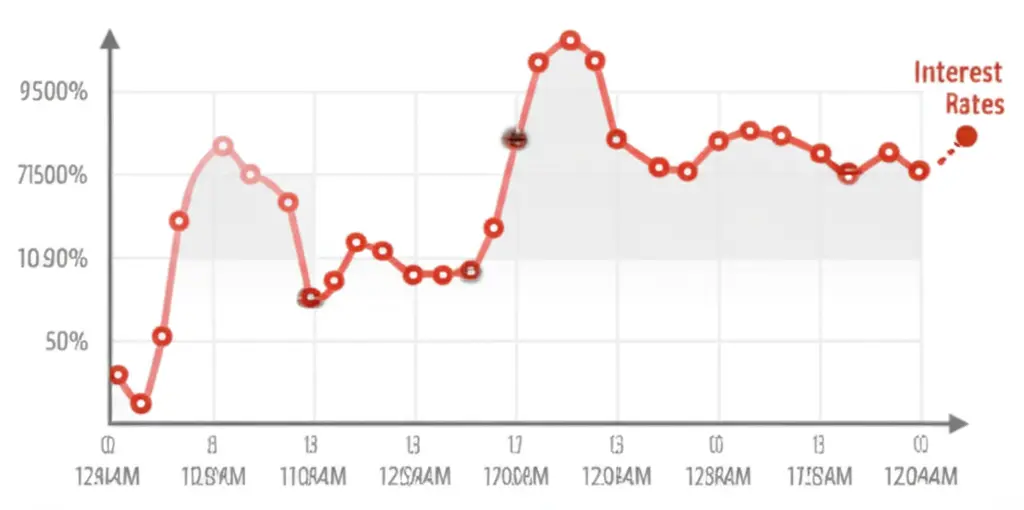

Understanding How Bank of Canada Interest Rate Announcements Affect Your Finances

Navigate the impact of interest rate changes on your personal finances in Canada.

Hey there! I was sipping coffee this morning when I saw the latest update from the Bank of Canada about their interest rate announcement. It got me thinking about how these changes ripple through our personal finances. So, I figured I’d chat with you today about what it all means in everyday terms and how you can navigate these waters like a pro.

Why Does the Bank of Canada Change Interest Rates?

First things first, let's talk about why the Bank of Canada adjusts interest rates. Essentially, it’s all about keeping the economy balanced. When inflation is rising, the Bank may increase rates to encourage savings and cooling off spending. Conversely, if the economy needs a nudge, they might lower rates to make borrowing cheaper, thereby stimulating spending.

How Do Interest Rate Changes Affect Your Loans?

If you’ve got a mortgage, car loan, or any type of variable-rate debt, you’re directly in the line of fire for these changes. An increase means your payments could go up—ouch! But on the flip side, a drop could see those payments shrink. Fixed-rate loans won’t change immediately with rate adjustments, but renewals might be at different rates.

Quick Tip: Consider Your Loan Type

For those with variable-rate debts, it’s a great time to review your options. Consider locking in a fixed rate if you think rates will keep rising. This could offer some financial peace of mind.

What About Savings and Investments?

Interest rate changes also mean shifts for savings accounts and investments. Higher rates could mean your savings start to earn a bit more. Yay for compound interest! However, they could also lead to drops in the stock market as borrowing costs for companies increase.

How Should You Respond to These Changes?

Most importantly, don’t panic. Economic shifts are as old as time. Plan and adapt. Trust in your financial goals but be agile enough to adjust plans as needed. Diversify your investments, keep an eye on your debt, and regularly assess your financial plans.

Wrapping Up

In short, interest rate changes can seem intimidating, but they’re really just part of the financial landscape's ebb and flow. Keep informed, be proactive, and remember that you can make strategic decisions to keep your finances healthy! How are you planning to adjust to the latest interest rate changes? I’d love to hear your thoughts.